5 Essential Facts About Your CIN Number

This article dives into the top five facts you need to know about CIN numbers, covering everything from "what is a CIN number" to its significance for businesses in India.

The Corporate Identification Number (CIN) plays a vital role in business registration and legal identification in India. For those involved in business consultation, understanding CIN is essential for guiding companies through compliance and regulatory procedures. This article dives into the top five facts you need to know about CIN numbers, covering everything from "what is a CIN number" to its significance for businesses in India.

What Is a CIN Number?

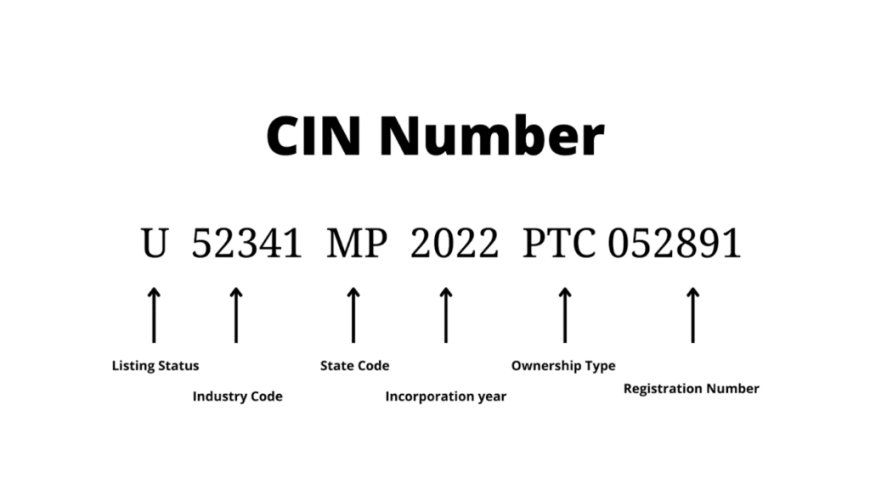

A Corporate Identification Number (CIN) is a unique 21-digit alphanumeric code provided by the Registrar of Companies (ROC) to companies registered in India. The CIN number full form represents "Corporate Identification Number." This unique identifier allows the government and other regulatory authorities to trace and monitor companies in the country. Each digit within the CIN has a specific meaning, providing details about the company’s structure, location, and registration.

1. Importance of the CIN Number in Business Registration

The CIN number is essential for business consultation experts and companies because it serves as a unique identifier for each company, similar to an individual’s social security number. It is crucial for tracking all registered companies' activities, ensuring that they adhere to legal regulations. Business consultants rely on the CIN to verify a company's existence and its compliance status.

2. Components of the CIN Number

The CIN is composed of multiple parts, each representing distinct information about the business. Here’s a breakdown of what the digits indicate:

-

First Character: Indicates the type of company (e.g., Public Limited, Private Limited).

-

Next Five Characters: Represent the industry code as per the Ministry of Corporate Affairs.

-

Two Characters: Indicate the state where the company is registered.

-

Four Characters: Denote the year of incorporation.

-

Remaining Digits: Are unique numbers assigned to each company by the ROC.

3. Where to Find the CIN Number

The CIN number can typically be found on a company’s registration certificate. It is also displayed on legal documents like financial statements, invoices, and annual reports. Companies must mention their CIN on various forms of official correspondence, as it is mandatory under the Companies Act, 2013.

4. The Role of CIN in Business Compliance

For companies operating in India, CIN is essential for ensuring legal compliance. A business consultation firm will often check a company's CIN to verify its registration status. The ROC tracks all company activities, and a CIN can reveal information regarding past compliance, regulatory filings, and even the company’s legitimacy. Failure to comply with CIN regulations can lead to penalties, making it a crucial number for both businesses and regulatory bodies.

5. CIN Is Specific to Registered Companies

Only entities registered with the Ministry of Corporate Affairs (MCA) under the Companies Act, 2013, receive a CIN. Thus, CIN is not applicable to sole proprietorships or partnership firms. For those in business consultation, advising clients on obtaining a CIN is essential for companies looking to establish themselves as registered entities under Indian law.

Conclusion

Understanding your CIN number is crucial for any business owner or business consultant working in the Indian corporate landscape. From the "CIN number full form" to its role in ensuring compliance, knowing what is a CIN number and its application can empower business owners and consultants alike. With the correct usage of CIN, companies can streamline regulatory processes, maintain legal compliance, and foster transparency in their operations.