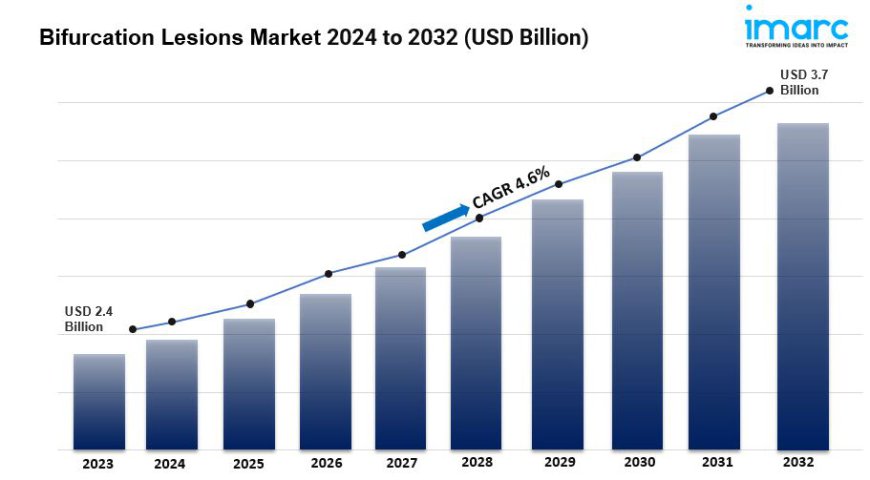

Bifurcation Lesions Market is Projected to Reach US$ 3.7 Billion by 2032

The global bifurcation lesions market size reached US$ 2.4 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 3.7 Billion by 2032, exhibiting a growth rate (CAGR) of 4.6% during 2024-2032.

Summary:

- The global bifurcation lesions market size reached US$ 2.4 Billion in 2023.

- The market is expected to reach US$ 3.7 Billion by 2032, exhibiting a growth rate (CAGR) of 4.6% during 2024-2032.

- Based on the types, the market has been classified as one and two stents.

- On the basis of the application, the market has been bifurcated into coronary and peripheral vascular.

- Based on the region, the market has been segmented into North America (the United States and Canada), Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others), Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others), Latin America (Brazil, Mexico, and others), and Middle East and Africa.

- The growth of the bifurcation lesions market share is driven by increasing healthcare expenditure and the expanding infrastructure of cardiac care facilities, especially in emerging markets.

- Governments and private institutions are investing heavily in advanced cardiovascular treatment centers, which is enabling wider access to specialized care for bifurcation lesions, thereby strengthening the market growth.

Industry Trends and Drivers:

Increasing prevalence of cardiovascular diseases: The rising incidence of cardiovascular diseases globally, particularly coronary artery disease (CAD), is a major driver for the bifurcation lesions market. Bifurcation lesions, which occur where one artery branches into two, are common in CAD patients and represent a complex subset of coronary lesions. With CVDs being the leading cause of mortality worldwide, the need for effective treatments like bifurcation lesion interventions has risen sharply. Aging populations in both developed and developing regions, as well as increasing lifestyle-related risk factors such as obesity, smoking, and poor diet, have contributed to the higher occurrence of CVDs. This growing patient pool requiring coronary interventions has resulted in increased demand for advanced solutions for bifurcation lesions, fueling market growth.

Advancements in stent technology: Technological advancements in stents and related devices used for treating bifurcation lesions have played a pivotal role in market expansion. Traditionally, treating bifurcation lesions was challenging due to the anatomical complexity and higher risk of restenosis or artery blockage after stenting. However, recent innovations such as drug-eluting stents (DES) and specialized bifurcation stents have significantly improved outcomes. DES, which releases medication to prevent scar tissue from forming, has reduced restenosis rates. Furthermore, the development of dedicated bifurcation stents, designed specifically to cater to the unique anatomy of bifurcations, has enhanced procedural success rates. These technological breakthroughs have made bifurcation lesion treatments more efficient and safer, leading to greater acceptance by interventional cardiologists and an increase in the number of procedures performed.

Growing adoption of minimally invasive procedures: The growing trend toward minimally invasive cardiac procedures is another key driver of the bifurcation lesions market. Percutaneous coronary intervention (PCI), which includes the placement of stents, has become the standard treatment for bifurcation lesions, offering an alternative to more invasive surgeries like coronary artery bypass grafting (CABG). Minimally invasive procedures are preferred due to shorter recovery times, reduced hospital stays, and lower risk of complications. This shift is particularly pronounced among elderly patients or those with multiple comorbidities, who may not be ideal candidates for open-heart surgery. The expansion of catheter-based interventions, aided by improved imaging and navigation systems, has further facilitated the growing adoption of these minimally invasive approaches in bifurcation lesion management.

Request for a sample copy of this report: https://www.imarcgroup.com/bifurcation-lesions-market/requestsample

Bifurcation Lesions Market Report Segmentation:

Breakup By Types:

- One-Stent

- Two-Stent

Based on the types, the market has been classified as one and two stents.

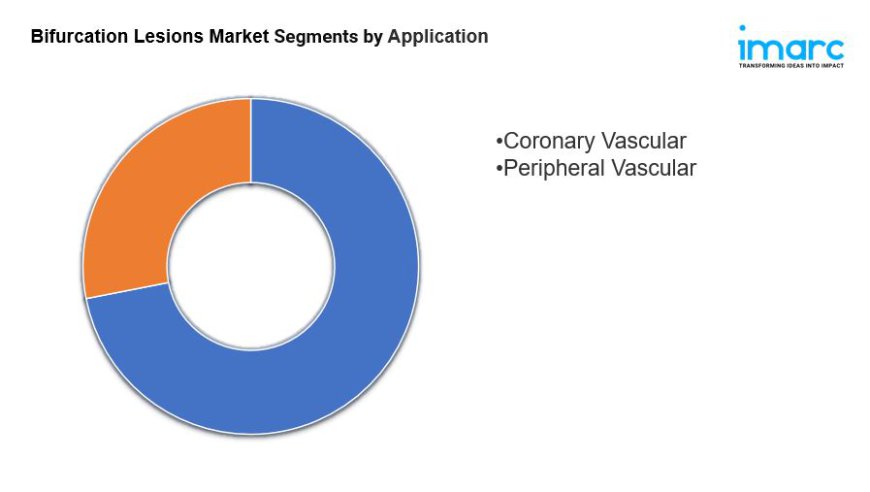

Breakup By Applications:

- Coronary Vascular

- Peripheral Vascular

On the basis of the application, the market has been bifurcated into coronary and peripheral vascular.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position owing to a large market for blinds and shades driven by high consumer spending on home decor and renovation.

Top Bifurcation Lesions Market Leaders:

The keyword market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- Boston Scientific Corporation

- Cardinal Health

- Medtronic plc

- Spectranetics (Koninklijke Philips N.V.) and Terumo Corporation

Browse full report with TOC & List of Figures: https://www.imarcgroup.com/bifurcation-lesions-market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

jamessmithjimmy12

jamessmithjimmy12