EMI Shielding Market Analysis, Trends & Forecast

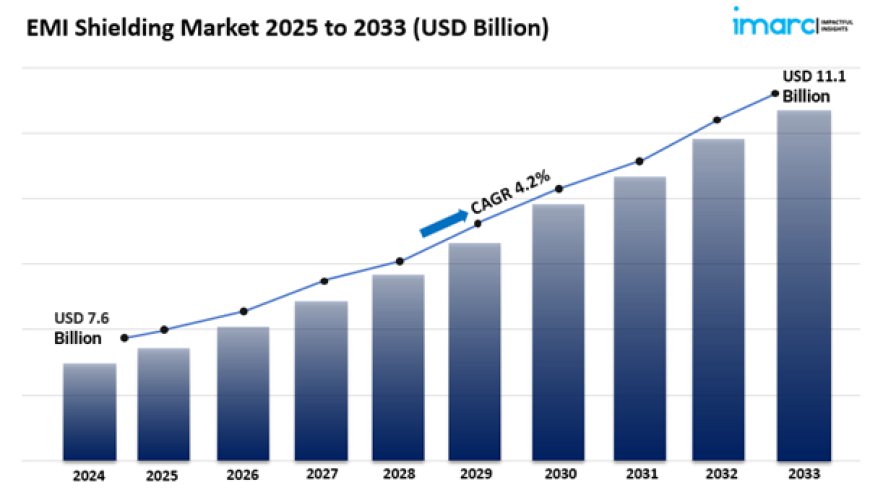

EMI shielding market size reached USD 7.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.1 Billion by 2033

IMARC Group has recently released a new research study titled “EMI Shielding Market Report by Material (EMI Shielding Tapes and Laminates, Conductive Coatings and Paints, Metal Shielding, Conductive Polymers, EMI/EMC Filters, and Others), Shielding Method (Radiation, Conduction), End-Use Industry (Consumer Electronics, Telecom and IT, Automotive, Healthcare, Defense and Aerospace, and Others), and Region 2024-2032”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

The global EMI shielding market size reached USD 7.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.1 Billion by 2033, exhibiting a growth rate (CAGR) of 4.2% during 2025-2033.

Request to Get the Sample Report:

Request to Get the Sample Report:

https://www.imarcgroup.com/emi-shielding-market/requestsample

EMI Shielding Market Trends

The EMI shielding market is set for major changes. In 2024, advanced devices and telecom will boost demand for better shielding. By 2025, the adoption of 5G and IoT will further this need, requiring strong EMI protection. The market will also shift towards new materials, like conductive polymers and nanomaterials. These offer better protection, are lighter, and more affordable. Meeting strict EMC standards will remain crucial, driving the need for top-quality solutions. The push for sustainability will lead to the creation of eco-friendly shielding materials. This aligns with global trends in greener manufacturing.

In summary, the market will grow, driven by tech, regulations, and the need for reliable systems.

Market Dynamics 1: Growing Demand in Electronics and Telecommunications

The EMI shielding market is growing fast. There is a rising demand for electronic devices and telecom equipment. As the world becomes more connected, the need for protection against electromagnetic interference (EMI) also increases. This is crucial for smart devices, wearables, and IoT apps. They are vulnerable to EMI. Such interference can disrupt their performance and data. Industries like consumer electronics, automotive, and telecom are heavily investing in EMI solutions.

They aim to meet regulations and boost product reliability. For example, the automotive sector is using advanced EMI materials in electric vehicles. This protects vital electronic components and systems. The telecom industry is now prioritizing EMI shielding. This aim is to enhance signal quality and reduce interference, especially with 5G technology. As manufacturers strive for better, more reliable products, the demand for innovative EMI solutions will keep growing. This trend positions the market for significant growth.

Market Dynamics 2: Advancements in EMI Shielding Materials

New materials are changing the EMI shielding market. By 2025, we expect to see conductive polymers, metal composites, and nanomaterials. These will boost shielding performance. They are lightweight and affordable, appealing to many industries. For instance, conductive polymers are popular for their flexibility. They allow for designs that metal shields can't match.

Meanwhile, nanotechnology is pushing boundaries. It creates materials with better conductivity and less thickness. This is key for compact consumer electronics. As industries strive for smaller, better products, demand for advanced materials will rise. This will spark more innovation and competition. Customizing materials for specific needs will give manufacturers an edge, boosting market growth.

Market Dynamics 3: Regulatory Compliance and Industry Standards

Regulatory compliance and standards are vital for the EMI shielding market. Manufacturers aim to meet strict electromagnetic compatibility (EMC) requirements. By 2025, increased regulations on EMI emissions and susceptibility will boost demand for shielding solutions across sectors. Agencies like the FCC and IEC regularly update standards to keep up with technological advancements and the rise of electronic devices. Companies must comply to avoid penalties and remain in the market. Manufacturers are now investing in better EMI shielding to meet standards and boost performance. This trend is particularly strong in healthcare, aerospace, and automotive sectors, where EMI issues are critical.

Moreover, the push for compliance not only raises the demand for shielding solutions but also encourages innovation in materials and design. Manufacturers aim to exceed regulatory requirements and customer expectations. As regulations evolve, the EMI shielding market will adapt. This will drive growth and innovation.

EMI Shielding Market Report Segmentation:

Breakup By Material:

· EMI Shielding Tapes and Laminates

· Conductive Coatings and Paints

· Metal Shielding

· Conductive Polymers

· EMI/EMC Filters

· Others

Conductive coatings and paints are widely used due to their versatility, cost-effectiveness, and ability to provide efficient EMI shielding across various applications.

Breakup By Shielding Method:

· Radiation

· Conduction

Radiation shielding is critical for protecting sensitive electronic components from electromagnetic waves, ensuring device reliability and compliance with stringent EMI regulations.

Breakup By End-Use Industry:

Consumer Electronics

· Smartphones

· Tablets

· Television

· Others

Telecom and IT

Automotive

Healthcare

Defense and Aerospace

Others

Consumer electronics holds the largest market share due to the rapid growth in the production and usage of smartphones, laptops, and wearables.

Breakup By Region:

· North America

· Asia Pacific

· Europe

· Latin America

· Middle East and Africa

North America's advanced electronics industry, stringent regulatory standards, and widespread adoption of 5G technology contribute to its leadership in the EMI shielding market.

Top EMI Shielding Market Leaders:

The EMI shielding market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

· 3M Company

· Parker Chomerics (Parker Hannifin)

· Dow Inc

· ETS-Lindgren (ESCO Technologies Holding Inc.)

· Henkel AG & Co. KGaA

· Kitagawa Industries (Nitto Kogyo Corporation)

· Laird Technologies Inc. (Advent International)

· Leader Tech Inc. (HEICO Corporation)

· PPG Industries

· RTP Company (Miller Waste Mills Inc.)

· Schaffner Holding AG

· Tech-Etch Inc.

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=2164&flag=C

Key Highlights of the Report:

· Market Performance (2018-2023)

· Market Outlook (2024-2032)

· Market Trends

· Market Drivers and Success Factors

· Impact of COVID-19

· Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: sales@imarcgroup.com

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800

marketresearch

marketresearch