Neobanking Market Analysis, Trends & Forecast

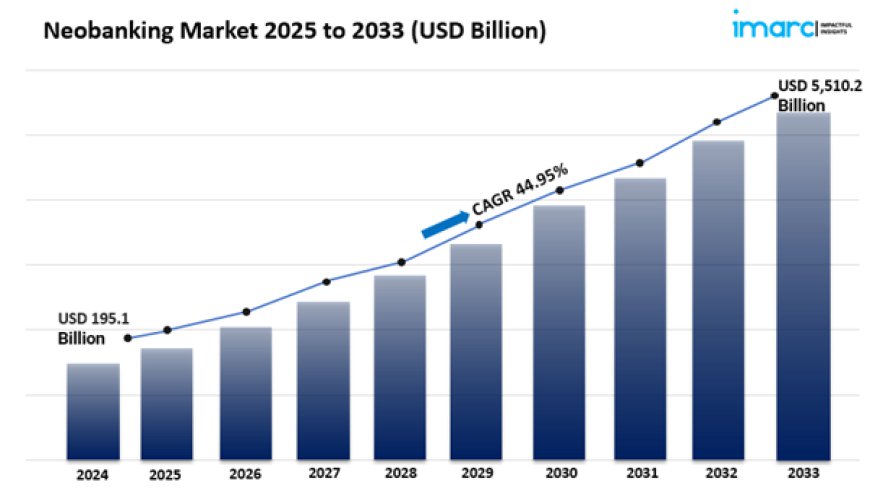

neobanking market size reached USD 195.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5,510.2 Billion by 2033

IMARC Group, a leading market research company, has recently released a report titled “Neobanking Market Report by Account Type (Business Account, Savings Account), Application (Enterprises, Personal, and Others), and Region 2025-2033”. The study provides a detailed analysis of the industry, including the neobanking market share, trends, size, and industry trends forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

The global neobanking market size reached USD 195.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5,510.2 Billion by 2033, exhibiting a growth rate (CAGR) of 44.95% during 2025-2033.

Request to Get the Sample Report:

https://www.imarcgroup.com/neobanking-market/requestsample

Neobanking Market Trend

The neobanking market is set to grow. It is adapting to consumer needs and technology. In 2023, digital banking is changing finance.

More people are choosing neobanks for their innovative and affordable services. By 2024, regulations will boost this growth. Open banking will enhance competition and choice. The push for financial education and inclusion will also increase demand. Neobanks offer accessible resources to underserved groups. This trend shows the need for innovation, customer focus, and inclusivity. Companies providing secure, easy, and educational services will thrive.

Market Dynamics 1: Rise of Digital-First Banking Solutions

The neobanking market is growing rapidly. This growth is fueled by digital-first solutions that meet tech-savvy consumers' needs.

More people are using smartphones and online platforms for financial tasks. This shift is challenging traditional banks. Neobanks, being agile and customer-focused, are at the forefront. By 2024, demand for neobanking services is expected to rise. Consumers are looking for easy, user-friendly experiences. Traditional banks often fall short in this area. Neobanks offer features like instant account setup, real-time alerts, and personalized tools. Their services enhance the banking experience.

Moreover, neobanks are cheaper. They usually have lower fees and offer better interest rates. This attracts more customers, especially younger ones who value convenience and digital interaction. As neobanks improve their services, they are set to capture a larger market share. This growth will push traditional banks to adapt and stay competitive.

Market Dynamics 2: Supportive Regulations and Open Banking

Supportive regulations and open banking initiatives are shaping the neobanking sector. Governments and regulators now see the need for innovation in finance. They are creating rules that boost competition and expand consumer choice. By 2024, new open banking rules will likely benefit neobanks. These rules will allow neobanks to access customer data from traditional banks, with permission. This access helps neobanks to offer tailored products and services.

Moreover, regulators are prioritizing consumer protection. They ensure neobanks meet standards for data safety and transparency. This builds trust and credibility for neobanks, boosting their popularity. Thus, the combination of supportive regulations and open banking not only aids neobanks' growth but also sparks innovation in finance. It encourages collaboration between traditional banks and fintech companies.

Market Dynamics 3: Boosting Financial Knowledge and Access

The neobanking market is growing due to a focus on financial education and access, especially for underserved groups. Neobanks use technology to offer easy financial services. They also promote financial knowledge, helping consumers manage their money. By 2024, the demand for neobanks is expected to rise. These banks will offer solutions for those excluded from traditional banking.

Features like budgeting tools, savings goals, and educational resources are now key parts of neobanking. These tools improve financial knowledge and decision-making. Neobanks also have easier lending criteria. This makes it simpler for people with low credit histories to get loans. This push for inclusion is growing neobanks' customer base. It's also helping communities achieve financial stability.

As more people recognize these benefits, the neobanking market will continue to grow, driven by its focus on inclusivity and education.

Neobanking Market Report Segmentation:

By Account Type:

· Business Account

· Savings Account

Business account accounted for the largest market share due to the growing demand from small and medium-sized enterprises for digital banking solutions that offer better financial management tools and lower fees compared to traditional banks.

By Application:

· Enterprises

· Personal

· Others

Enterprises represented the largest segment as large organizations seek comprehensive and scalable financial solutions that can integrate seamlessly with their existing systems and support global operations.

Regional Insights:

· North America

· Asia-Pacific

· Europe

· Latin America

· Middle East and Africa

Europe’s dominance in the neobanking market is attributed to the advanced technological infrastructure, supportive regulatory environment, and high adoption rate of digital banking services among consumers and businesses.

The competitive landscape of the digital payment market size has been studied in the report with the detailed profiles of the key players operating in the market.

Some of These Key Players Include:

· Agricultural Bank of China Limited

· Atom Bank PLC

· Citigroup Inc.

· Deutsche Bank AG

· Fidor Solutions AG (Groupe BPCE)

· HSBC Holdings Plc

· Malayan Banking Berhad

· Monzo Bank Limited

· Movencorp Inc.

· N26 GmbH

· Simple Finance Technology Corporation (BBVA USA)

· Ubank Limited

· Webank Co. Ltd.

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=3488&flag=C

Key Highlights of the Report:

· Market Performance (2018-2023)

· Market Outlook (2024-2032)

· Market Trends

· Market Drivers and Success Factors

· Impact of COVID-19

· Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: sales@imarcgroup.com

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800

marketresearch

marketresearch