AML Verification and the Role of Online Fingerprint Scanners in Secure Transactions

By embracing biometric authentication, organizations can enhance their security measures while delivering a seamless user experience, paving the way for a safer and more transparent financial ecosystem.

In today’s rapidly evolving digital world, combating financial crimes such as money laundering has become increasingly challenging. Regulatory bodies around the globe have implemented strict Anti-Money Laundering (AML) guidelines to ensure financial integrity and prevent illegal activities. One of the most effective ways to adhere to these regulations is through robust identity verification processes, and online fingerprint scanners have emerged as a powerful tool in this fight.

In this article, we will explore the importance of AML verification, the rise of online fingerprint scanners, and how they work together to ensure safe and secure transactions.

What is AML Verification?

AML (Anti-Money Laundering) verification refers to the processes that financial institutions and businesses use to detect, prevent, and report money laundering activities. The aim is to stop illegal funds from entering the financial system and mitigate the risks of terrorist financing, tax evasion, and other financial crimes. AML verification involves:

- Customer Due Diligence (CDD): This process helps institutions understand the identity and financial activities of their customers. It involves gathering personal details such as name, address, date of birth, and identity documents.

- Know Your Customer (KYC): KYC procedures are designed to verify the authenticity of the customer's identity. It typically involves document verification and biometric verification processes.

- Transaction Monitoring: Continuous monitoring of transactions to detect suspicious activities and trigger alerts for further investigation.

Why AML Verification is Crucial

AML compliance is not only a legal requirement but also essential for maintaining trust in the financial ecosystem. Companies that fail to comply with AML regulations face hefty fines, legal consequences, and reputational damage. Moreover, implementing stringent AML measures helps to:

- Protect businesses from being used as tools for criminal activities.

- Ensure that companies operate within legal frameworks.

- Build customer trust by promoting secure and transparent transactions.

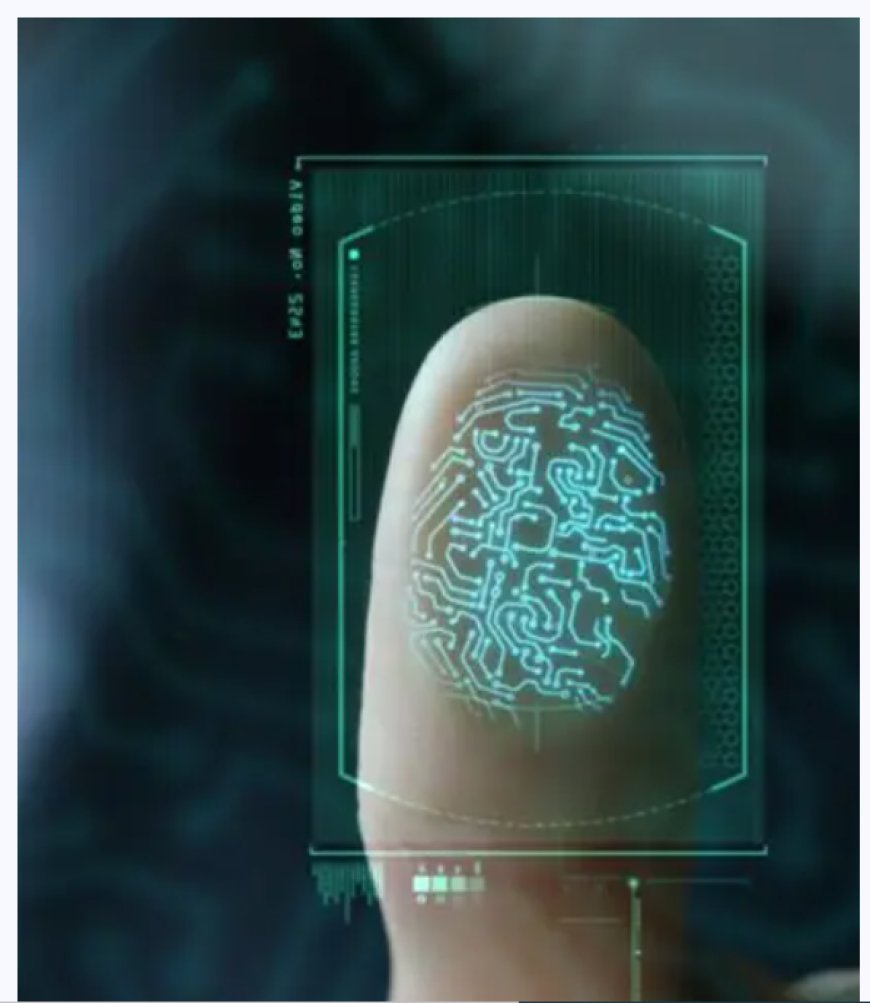

Online Fingerprint Scanners: A Key Tool in AML Verification

With the rise of digital banking, e-commerce, and remote work, ensuring secure and convenient identity verification has become paramount. One of the most reliable methods of verifying an individual’s identity is through biometric authentication, and online fingerprint scanners have become a critical component of this process.

How Online Fingerprint Scanners Work

An online fingerprint scanner captures the unique patterns of ridges and valleys present on a person’s fingertip. These patterns are nearly impossible to replicate, making fingerprints a highly secure form of biometric authentication. When integrated into an AML verification system, online fingerprint scanners work in the following way:

- Data Capture: The fingerprint scanner captures the user's fingerprint data during the registration or login process.

- Feature Extraction: The system extracts unique features from the fingerprint image, such as minutiae points, ridges, and bifurcations.

- Comparison and Matching: The extracted features are compared to the stored fingerprint data in the system to authenticate the user’s identity.

- Verification and Approval: If the fingerprint matches the stored data, the user is verified and allowed to proceed with the transaction.

Benefits of Online Fingerprint Scanners in AML Verification

-

Enhanced Security: Fingerprints are unique to each individual and cannot be easily replicated or stolen. This makes fingerprint scanning a highly secure method for verifying identity and reducing the risk of fraud in financial transactions.

-

Frictionless User Experience: Biometric verification through fingerprint scanning is fast, convenient, and requires minimal effort from the user. This makes the authentication process smoother while maintaining high levels of security.

-

Real-time Verification: Online fingerprint scanners allow for instant identity verification, ensuring that suspicious activities can be flagged and addressed in real-time. This is crucial for effective AML compliance and reporting.

-

Reduced Identity Theft: Since fingerprint biometrics cannot be easily forged, the use of online fingerprint scanners significantly reduces the risk of identity theft and impersonation.

-

Regulatory Compliance: By implementing biometric authentication, businesses can ensure they meet strict AML and KYC requirements, which helps them avoid fines and legal repercussions.

AML Verification and Biometric Authentication: A Winning Combination

The integration of AML verification with biometric authentication technologies, such as online fingerprint scanners, offers a powerful solution for businesses looking to secure their transactions. This combination not only enhances the security of financial operations but also ensures that companies stay compliant with stringent regulatory requirements. With digital transformation accelerating, online fingerprint scanning will continue to play a crucial role in safeguarding financial systems against criminal activities.

Conclusion

In an era where cyber threats and financial crimes are becoming increasingly sophisticated, businesses must adopt advanced technologies to stay ahead. AML verification, combined with online fingerprint scanners, provides a robust and reliable way to ensure secure transactions, protect customer data, and maintain compliance with regulatory standards.

By embracing biometric authentication, organizations can enhance their security measures while delivering a seamless user experience, paving the way for a safer and more transparent financial ecosystem

kathie

kathie