Chemical Vapour Deposition (CVD) Equipment Market Share, Size, Industry Overview, Growth and Forecast 2024-2032

Our report has categorized the market based on technology, application, and end user.

Chemical Vapour Deposition (CVD) Equipment Market 2024-2032:

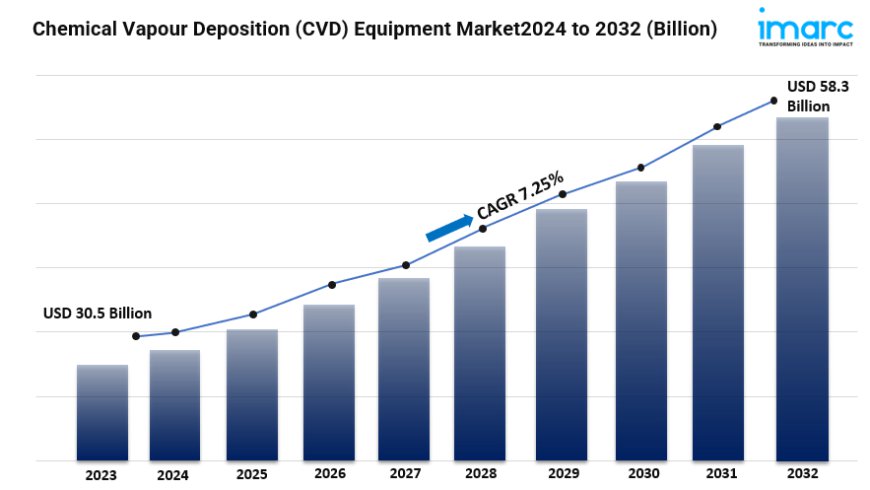

- The global chemical vapour deposition (CVD) equipment market size reached USD 30.5 Billion in 2023.

- The market is expected to reach USD 58.3 Billion by 2032, exhibiting a growth rate (CAGR) of 7.25% during 2024-2032.

- Asia Pacific leads the market, accounting for the largest chemical vapour deposition (CVD) equipment market share due to the strong presence of semiconductor manufacturers and growing investment in electronics.

- Low pressure CVD (LPCVD) accounts for the majority of the market share in the technology segment owing to its ability to produce high-quality thin films.

- Electronics holds the largest share in the chemical vapour deposition (CVD) equipment industry as CVD is important for producing various components.

- Foundry remains a dominant segment in the market because of the increasing outsourcing of semiconductor manufacturing.

- The rising product demand in semiconductor manufacturing is a primary driver of the chemical vapour deposition (CVD) equipment market.

- Technological advancements and significant growth in solar energy applications are reshaping the chemical vapour deposition (CVD) equipment market.

Industry Trends and Drivers:

- Growing Demand in Semiconductor Manufacturing:

The semiconductor industry is experiencing unprecedented growth, driven by the global demand for advanced electronics and digital technologies. This surge directly fuels the market for CVD equipment, a critical component in semiconductor fabrication. As consumer preferences shift towards devices that are faster, more compact, and energy-efficient, manufacturers are pushed to enhance their processes for producing smaller and more efficient chips. CVD equipment plays a pivotal role in the deposition of ultra-thin films that form essential layers in semiconductor devices. The technology ensures uniformity and precision in film thickness, enabling the development of complex microelectronic structures that meet industry standards. Additionally, the expansion of technologies like artificial intelligence (AI), the Internet of Things (IoT), and fifth-generation (5G) networks has amplified the need for sophisticated integrated circuits and components.

- Growth in Solar Energy Applications:

The drive for renewable energy solutions has significantly impacted the CVD equipment market, particularly in the solar energy sector. Thin-film solar panels, known for their lightweight nature and flexibility, are increasingly being adopted due to their efficiency and cost-effectiveness. CVD technology is essential in the fabrication of these panels, providing a method for creating high-quality, uniform thin films that optimize the conversion of sunlight into electricity. This capability has positioned CVD as an indispensable tool for photovoltaic cell manufacturers. Government policies and incentives supporting the transition to green energy further accelerate the growth of solar projects, bolstering the demand for CVD equipment. Additionally, research and development (R&D) in improving the efficiency of solar cells, such as using novel materials like perovskite and multi-junction cells, often rely on advanced CVD processes for deposition.

- Advancements in Nanotechnology and Material Science:

Nanotechnology and material science advancements are unlocking new potential across various industries, with CVD equipment playing a central role. The ability to deposit materials at the atomic and molecular levels using CVD is pivotal for creating structures with enhanced physical and chemical properties. For example, CVD is employed in the synthesis of graphene and carbon nanotubes, materials renowned for their extraordinary electrical conductivity, mechanical strength, and thermal stability. These materials have applications spanning electronics, aerospace, medical devices, and even energy storage solutions like batteries and supercapacitors. As the scope of nanotechnology expands, so does the demand for precise and reliable CVD equipment that can facilitate the deposition of specialized thin films. Industries seeking innovation through advanced materials leverage CVD to achieve the uniformity, scalability, and quality essential for large-scale production.

Request for a sample copy of this report: https://www.imarcgroup.com/chemical-vapour-deposition-equipment-market/requestsample

Chemical Vapour Deposition (CVD) Equipment Market Report Segmentation:

Breakup By Technology:

- Plasma Enhanced CVD (PECVD)

- Low Pressure CVD (LPCVD)

- Metal Organic CVD (MOCVD)

- Atmospheric Pressure CVD (APCVD)

- Others

Low pressure CVD (LPCVD) accounts for the majority of shares due to its ability to produce high-quality, uniform thin films at a lower cost, making it widely adopted in semiconductor manufacturing.

Breakup By Application:

- Coatings

- Electronics

- Catalysis

- Others

Electronics dominates the market as CVD is essential for producing various components, including integrated circuits and microchips, in the rapidly expanding electronics industry.

Breakup By End User

- Memory

- Foundry

- IDM

- Logic

Foundry represents the majority of shares because of the increasing outsourcing of semiconductor manufacturing to specialized foundries for efficient and cost-effective production.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific holds the leading position owing to the region's strong presence of semiconductor manufacturers and growing investments in electronics and renewable energy industries.

Top Chemical Vapour Deposition (CVD) Equipment Market Leaders:

The chemical vapour deposition (CVD) equipment market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- Aixtron SE

- Applied Materials Inc.

- CVD Equipment Corporation

- IHI Corporation

- Jusung Engineering Co. Ltd.

- Lam Research Corporation

- Oxford Instruments plc

- Plasma-Therm LLC

- ULVAC Inc.

- Veeco Instruments Inc.

Ask Analyst & Browse full report with TOC List of Figures: https://www.imarcgroup.com/request?type=report&id=7378&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

torylanez27

torylanez27