Drug-Eluting Stents Market Size, Share, Growth, Key Players Analysis & Forecast Report 2024-2032

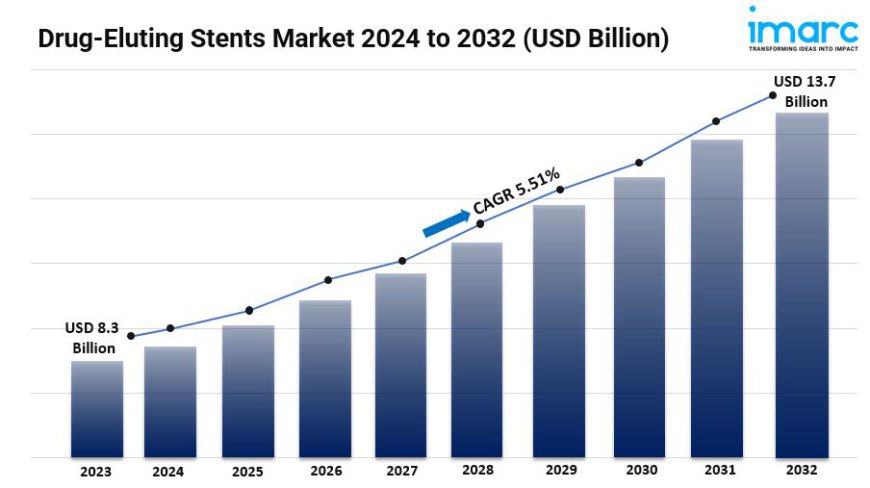

The global drug-eluting stents market size reached USD 8.3 Billion in 2023. Looking forward, the market is expected to reach USD 13.7 Billion by 2032, exhibiting a growth rate (CAGR) of 5.51% during 2024-2032. The increasing prevalence of cardiovascular diseases is propelling the market.

Global Drug-Eluting Stents Market Size, Share & Growth Research Report 2024-2032

- The global drug-eluting stents market size reached USD 8.3 Billion in 2023.

- The market is expected to reach USD 13.7 Billion by 2032, exhibiting a growth rate (CAGR) of 5.51% during 2024-2032.

- North America leads the market, accounting for the largest drug-eluting stents market share due to high healthcare spending.

- Polymer free coating accounts for the majority of the market share in the coating segment owing to its reduced risk of inflammation and thrombosis.

- Based on the drug, the market has been divided into sirolimus, paclitaxel, zotarolimus, everolimus, biolimus, and others.

- Cobalt-chromium holds the largest share in the drug-eluting stents industry because of its strength and flexibility.

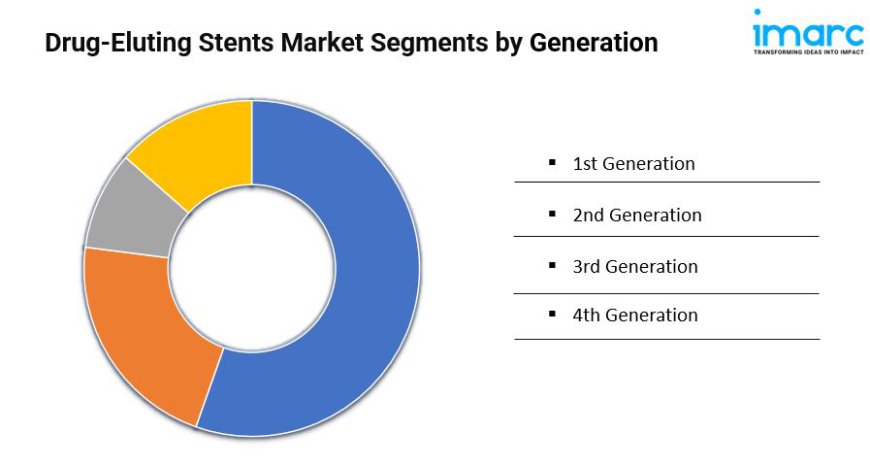

- On the basis of generation, the market has been divided into 1st generation, 2nd generation, 3rd generation, and 4th generation.

- Coronary artery disease remains a dominant segment in the market, as it remains the most common cardiovascular condition.

- Hospitals represent the leading end user segment due to their extensive facilities and expertise.

- The rising prevalence of cardiovascular diseases across the globe is a primary driver of the drug-eluting stents market.

- Technological advancements and the increasing geriatric population are reshaping the drug-eluting stents market.

Request to Get the Sample Report: https://www.imarcgroup.com/drug-eluting-stents-market/requestsample

Industry Trends and Drivers:

- Growing Prevalence of Cardiovascular Diseases:

According to the latest market analysis report, the increasing incidence of cardiovascular diseases (CVD) worldwide is significantly boosting the drug-eluting stents (DES) market size. As the leading cause of death globally, cardiovascular diseases, including coronary artery disease (CAD), require effective, long-term management solutions. DES provide a targeted therapy by releasing antiproliferative drugs directly into the arterial walls, reducing the chances of restenosis.

With risk factors such as obesity, hypertension, diabetes, and smoking on the rise, the burden of cardiovascular diseases continues to escalate. This upward trend is particularly notable in low- and middle-income countries where rapid urbanization and lifestyle changes are increasing CVD rates. Additionally, the sedentary lifestyle prevalent in developed nations contributes to this rise.

- Rising Geriatric Population:

The significant growth in geriatric population is a crucial driver for the DES market share. These adults are more susceptible to cardiovascular conditions, including coronary artery disease, due to age-related physiological changes and a higher prevalence of comorbidities. This demographic shift increases the demand for DES, as seniors often require stents to maintain coronary artery health.

Concurrently, healthcare expenditure is rising globally, with governments and private sectors investing in advanced medical technologies to improve care quality. Reimbursement policies in developed regions make DES more accessible to a broader population, particularly among the elderly who benefit significantly from these policies.

- Technological Advancements:

Advances in drug-eluting stent technology have made DES more effective, safer, and durable, propelling the market forward. Early-generation DES faced challenges such as late stent thrombosis and limited control over drug release, but newer iterations have addressed these issues. Modern DES use biodegradable polymers and advanced drug-coating techniques, allowing for better biocompatibility and controlled drug release that matches the healing process of the artery.

These stents also reduce the risk of adverse reactions, such as inflammation or thrombosis, as they gradually dissolve in the body. Additionally, innovations in bioresorbable stents, which completely dissolve over time, further reduce long-term risks associated with permanent implants.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=4815&flag=C

Drug-Eluting Stents Market Report Segmentation:

Breakup By Coating:

- Polymer Based Coating

- Polymer Free Coating

Polymer free coating accounts for the majority of shares due to its reduced risk of inflammation and thrombosis, appealing to both physicians and patients focused on safety.

Breakup By Drug:

- Sirolimus

- Paclitaxel

- Zotarolimus

- Everolimus

- Biolimus

- Others

Based on the drug, the market has been divided into sirolimus, paclitaxel, zotarolimus, everolimus, biolimus, and others.

Breakup By Stent Platform:

- Stainless-steel

- Cobalt-Chromium

- Platinum-Chromium

- Nitinol

- Others

Cobalt-chromium represents the majority of shares because of its strength, flexibility, and biocompatibility, making it a preferred material for durable stents.

Breakup By Generation:

- 1st Generation

- 2nd Generation

- 3rd Generation

- 4th Generation

On the basis of generation, the market has been divided into 1st generation, 2nd generation, 3rd generation, and 4th generation.

Breakup By Application:

- Coronary Artery Disease

- Peripheral Artery Disease

Coronary artery disease exhibits a clear dominance as it remains the most common cardiovascular condition requiring stent intervention to manage blocked arteries effectively.

Breakup By End User:

- Hospitals

- Ambulatory Surgical Centers

- Others

Hospitals exhibit a clear dominance due to their extensive facilities, expertise, and patient inflow for stent procedures, especially for critical cardiovascular care.

Breakup By Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds the leading position owing to high healthcare spending, advanced medical infrastructure, and a significant prevalence of cardiovascular diseases.

Top Drug-Eluting Stents Market Leaders: The drug-eluting stents market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- Abbott Laboratories

- B. Braun Melsungen AG

- Biosensors International Group Ltd.

- Biotronik

- Boston Scientific Corporation

- Cardinal Health Inc.

- Cook Medical LLC (Cook Group Incorporated)

- Lepu Medical Technology (Beijing) Co. Ltd.

- Medtronic plc

- MicroPort Scientific Corporation

- Sino Medical Sciences Technology Inc.

- Terumo Corporation

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1–631–791–1145

businessnews

businessnews