Identity Verification Market Outlook, Industry Size, Growth Factors & Investment Opportunity 2024-2032

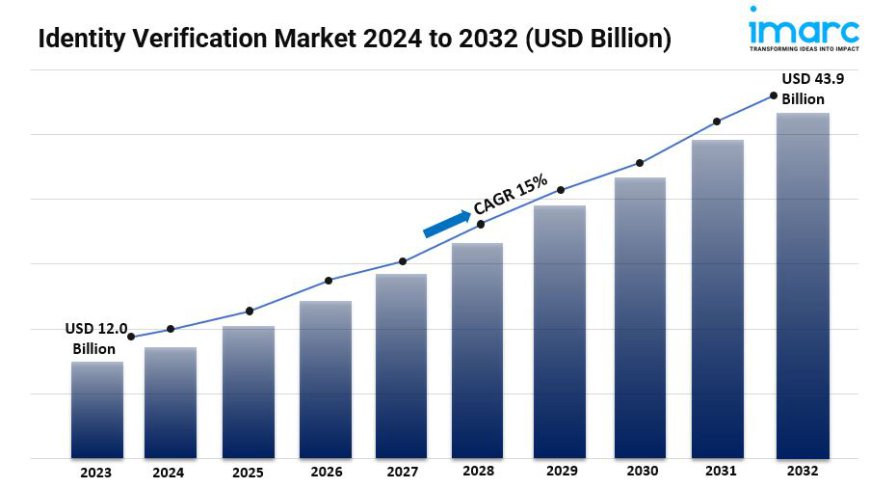

The global identity verification market size reached US$ 12.0 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 43.9 Billion by 2032, exhibiting a growth rate (CAGR) of 15% during 2024-2032.

Summary:

- The global identity verification market size reached USD 12.0 Billion in 2023.

- The market is expected to reach USD 43.9 Billion by 2032, exhibiting a growth rate (CAGR) of 15% during 2024-2032.

- North America leads the market, accounting for the largest identity verification market share.

- Biometrics accounts for the majority of the market share in the type segment due to its excellent security and accuracy when it comes to identifying people using distinctive physical characteristics like fingerprints and facial recognition.

- The solution holds the largest share in the identity verification industry.

- On-premises remains a dominant segment in the market because a lot of businesses would rather keep direct control over sensitive identity information.

- Large enterprises represent the leading application segment.

- BFSI accounts for the majority of the market share in the vertical segment due to the necessity of secure identity verification in order to avoid fraud and adhere to strict financial regulations.

- The rise of remote work and digital onboarding has driven the demand for identity verification solutions to securely authenticate employees and customers from distant locations.

- The increasing use of artificial intelligence (AI) and machine learning (ML) in verification processes enhances accuracy and reduces verification time, further supporting the market growth.

Request to Get the Sample Report: https://www.imarcgroup.com/identity-verification-market/requestsample

Industry Trends and Drivers:

- The Increasing Number of Digital Transactions:

As businesses and consumers increasingly shift toward online platforms for conducting financial transactions, e-commerce, and other activities, the need for secure verification processes has grown significantly. The rise in digital banking, online shopping, and remote services has created an urgent need to authenticate users and prevent unauthorized access to sensitive information.

Identity verification solutions, such as biometric authentication, multi-factor authentication (MFA), and knowledge-based verification, are becoming critical to ensure that individuals engaging in online transactions are who they claim to be. This growth in digital services, enhanced by global trends such as the expansion of e-commerce and digital payment platforms, is pushing companies to invest in advanced identity verification solutions to enhance security and build consumer trust.

- Rising Instances of Identity Fraud:

Cybercriminals and fraudsters continuously exploit vulnerabilities in traditional identification systems, resulting in increasing financial losses for businesses and individuals. Identity theft, account takeovers, and fraudulent activities are on the rise, driven by the growing availability of personal information on the dark web and advancements in hacking techniques.

According to several industry reports, identity fraud incidents have surged, causing significant financial damage globally. To combat these threats, organizations are turning to identity verification technologies that provide more robust protection. Biometric technologies, such as facial recognition, fingerprint scanning, and behavioral biometrics, offer stronger security than traditional methods like passwords or PINs, making it more difficult for fraudsters to impersonate legitimate users thus strengthening the market growth.

- Stringent Regulatory Compliance Requirements Across Industries:

Regulatory compliance and data protection laws also play a significant role in driving the identity verification market. Governments and regulatory bodies worldwide have introduced stringent regulations to combat money laundering, terrorist financing, and other illegal activities. These regulations, such as Know Your Customer (KYC), Anti-Money Laundering (AML), and the General Data Protection Regulation (GDPR), require businesses, particularly in the financial services sector, to verify the identities of their customers accurately.

Failure to comply with these regulations can result in hefty fines and reputational damage. As a result, organizations are increasingly integrating identity verification solutions into their processes to meet regulatory standards, avoid penalties, and maintain customer trust, thus aiding the market growth.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=4704&flag=C

Identity Verification Market Report Segmentation:

Breakup By Type:

- Biometrics

- Non-Biometrics

Biometrics account for the majority of shares due to their high accuracy and security in verifying identities through unique physical traits like fingerprints and facial recognition.

Breakup By Component:

- Solutions

- Services

Solutions dominate the market growth as businesses increasingly require comprehensive identity verification systems to manage compliance and security.

Breakup By Deployment Mode:

- On-premises

- Cloud-based

On-premises holds the majority of shares because many organizations prefer maintaining direct control over sensitive identity data.

Breakup By Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises represent the majority of shares as they are more likely to invest in advanced identity verification solutions to manage large customer bases and regulatory compliance.

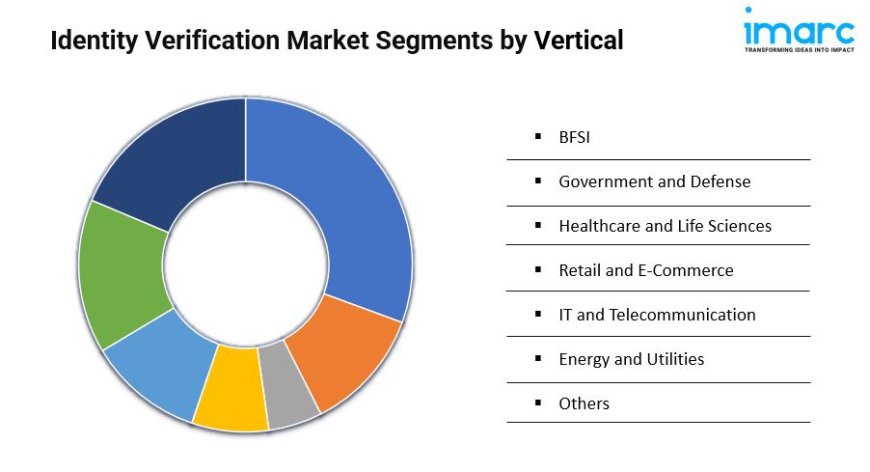

Breakup By Vertical:

- BFSI

- Government and Defense

- Healthcare and Life Sciences

- Retail and E-Commerce

- IT and Telecommunication

- Energy and Utilities

- Others

BFSI exhibits a clear dominance due to its high need for secure identity verification to prevent fraud and comply with stringent financial regulations.

Breakup By Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds the leading position, driven by high digitalization rates, advanced technology adoption, and strong regulatory frameworks around data security.

Top Identity Verification Market Leaders: The identity verification market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- Acuant Inc.

- AuthenticID Inc.

- Equifax Inc.

- Experian PLC

- Intellicheck Inc.

- Jumio Corporation

- Mastercard Inc.

- Mitek Systems Inc.

- Onfido

- Thales Group

- TransUnion

- Trulioo

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1–631–791–1145

businessnews

businessnews