Marine Insurance Market Size, Share, Trends, Industry Analysis & Forecast Report 2024-2032

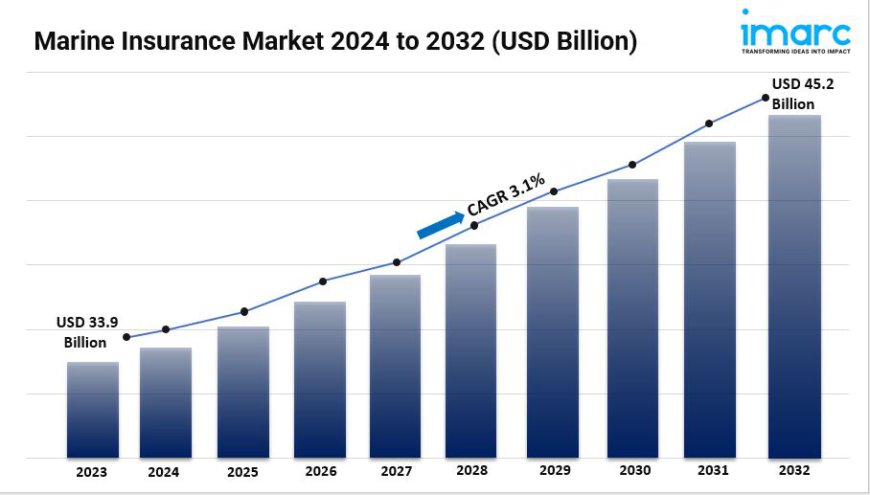

The global marine insurance market size reached US$ 33.9 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 45.2 Billion by 2032, exhibiting a growth rate (CAGR) of 3.1% during 2024-2032.

Summary:

- The global marine insurance market size reached USD 33.9 Billion in 2023.

- The market is expected to reach USD 45.2 Billion by 2032, exhibiting a growth rate (CAGR) of 3.1% during 2024-2032.

- Europe leads the market, accounting for the largest marine insurance market share.

- Cargo insurance accounts for the majority of the market share in the type segment as it offers financial protection and peace of mind to companies, which is leading to a positive marine insurance market forecast.

- Wholesalers holds the largest share in the marine insurance industry.

- Traders represents the leading application segment.

- The increasing number of small and medium-sized enterprises (SMEs) entering global trade is also pushing market expansion.

- Mergers and acquisitions among key players in the industry create growth opportunities, consolidating the market.

Request to Get the Sample Report: https://www.imarcgroup.com/marine-insurance-market/requestsample

Industry Trends and Drivers:

- Increasing International Trade and Expanding Maritime Logistics

The growth of global marine insurance is closely linked to the expansion of international trade and maritime logistics. As global markets continue to open up, the demand for transporting goods across oceans is steadily increasing. Shipping remains the most cost-effective means for bulk transport, making marine insurance a vital tool to protect against potential losses during transit. With the rise of e-commerce and businesses looking to expand internationally, maritime transport services have surged.

This rise in shipping volume elevates the demand for comprehensive marine insurance, covering risks such as damage, theft, or delays. Additionally, the growth of port infrastructure and advanced shipping routes further amplifies the role of marine insurance in securing global trade. Marine insurers offer tailored solutions for various industries, ensuring businesses can manage risks and continue to thrive in a highly interconnected world of trade and commerce.

- Adoption of Cargo Transportation Services

The adoption of cargo transportation services has significantly increased, directly impacting the demand for marine insurance. As businesses globally rely more on shipping to move goods efficiently, the need for insuring these shipments has become more critical. Cargo insurance offers protection against damages, losses, or unforeseen disruptions during transit, ensuring financial stability for companies. Logistics companies and shipping operators actively seek marine insurance to mitigate potential liabilities that arise from damaged or lost goods, delays, and other risks.

The expansion of the global supply chain and the rise of just-in-time delivery models place even more importance on safeguarding cargo. Marine insurance policies are evolving to address specific business needs, offering more specialized coverage for high-value goods and perishable items, further driving the adoption of insurance solutions tailored to growing cargo transport services.

- Technological Advancements like Blockchain

Technological advancements, particularly the use of blockchain in marine insurance, are transforming the industry by enhancing efficiency, transparency, and security. Blockchain technology allows for the seamless tracking of shipments, creating a digital ledger that provides real-time data, minimizes fraud, and ensures better coordination between stakeholders. Smart contracts within blockchain systems automatically trigger insurance policies based on predefined conditions, reducing paperwork and speeding up claims processing.

Insurers benefit from these innovations as they can reduce administrative costs while providing more precise and tailored policies. Blockchain also addresses issues like data breaches and cyber-attacks by securing sensitive information shared between parties. This technological integration is particularly beneficial for multinational companies with complex supply chains, as it simplifies risk management and improves overall operational efficiency, thereby boosting the adoption of blockchain-enhanced marine insurance solutions worldwide.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=4690&flag=C

Marine Insurance Market Report Segmentation:

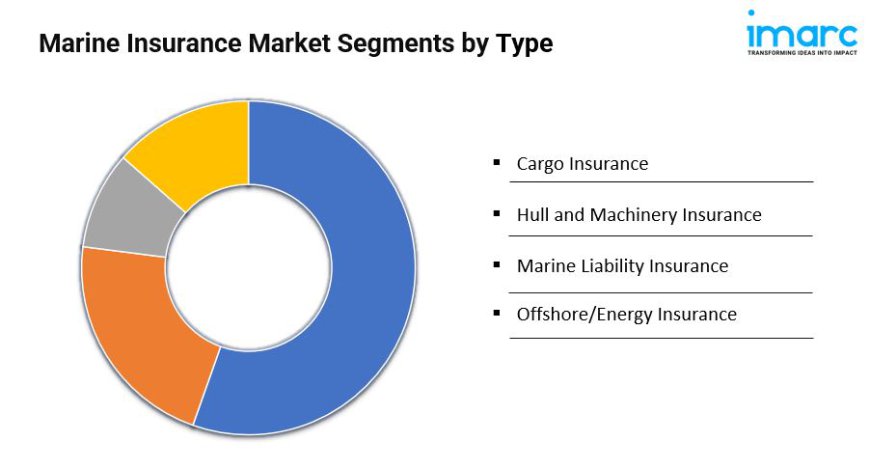

Breakup By Type:

- Cargo Insurance

- Hull and Machinery Insurance

- Marine Liability Insurance

- Offshore/Energy Insurance

Cargo insurance represented the largest segment in the marine insurance market by type due to the substantial value of goods being transported globally, necessitating comprehensive coverage against potential risks such as damage, loss, or theft during transit.

Breakup By Distribution Channel:

- Wholesalers

- Retail Brokers

- Others

Wholesalers represented the largest segment in terms of distribution channel for marine insurance, as they often handle bulk shipments of goods and require specialized coverage tailored to their unique needs and risks.

Breakup By End User:

- Ship Owners

- Traders

- Others

Traders represented the largest segment by frequency in the marine insurance market, as they engage in frequent transactions involving the shipment of goods and thus require insurance coverage for each transaction to mitigate potential financial losses.

Breakup By Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe emerged as the largest market in the marine insurance sector by region due to its significant maritime trade activities, extensive coastline, and presence of major ports and shipping hubs, driving robust demand for insurance products to protect against maritime risks within the region.

Top Marine Insurance Market Leaders: The marine insurance market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

Some of the key players in the market are:

- Allianz SE

- American International Group Inc.

- Aon plc

- Arthur J. Gallagher & Co.

- AXA S.A

- Beazley plc

- Brown & Brown Inc.

- Chubb Group Holdings Inc

- Lloyd's of London

- Lockton Companies

- Marsh & McLennan Companies Inc.

- QBE Insurance Group Ltd

- Swiss Re Ltd

- Willis Towers Watson plc

- Zurich Insurance Group Ltd.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1–631–791–1145

businessnews

businessnews