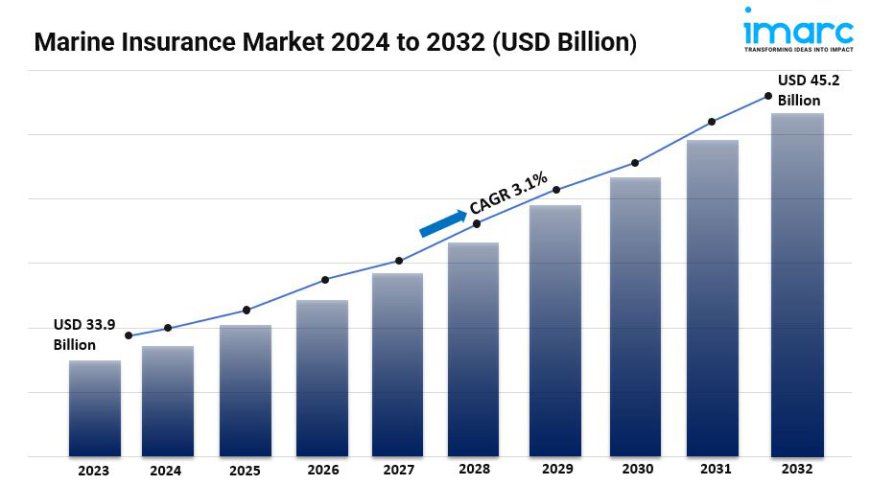

Marine Insurance Market is Expected To Grow at a CAGR of 3.1% by 2032

The global marine insurance market size reached US$ 33.9 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 45.2 Billion by 2032, exhibiting a growth rate (CAGR) of 3.1% during 2024-2032.

Summary:

- The global marine insurance market size reached USD 33.9 Billion in 2023.

- The market is expected to reach USD 45.2 Billion by 2032, exhibiting a growth rate (CAGR) of 3.1% during 2024-2032.

- Europe leads the market, accounting for the largest marine insurance market share.

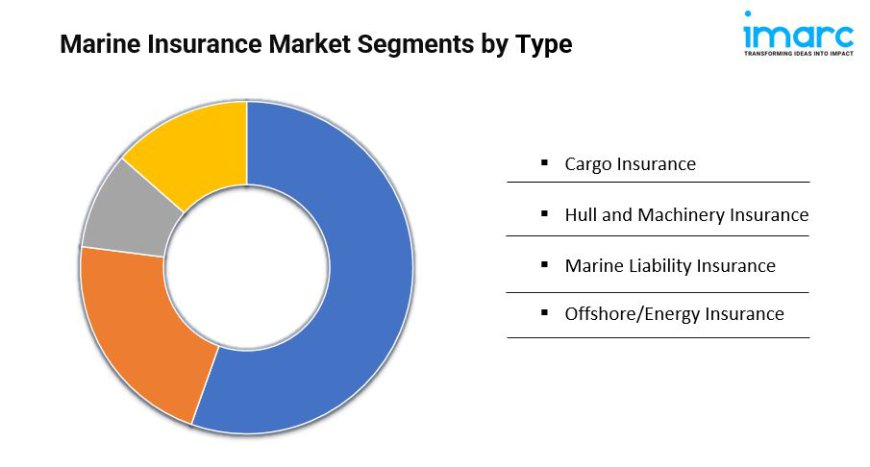

- Cargo insurance accounts for the majority of the market share in the type segment due to essential coverage for goods while they are in transit, guarding against typical dangers like theft, loss, or damage.

- Wholesaler holds the largest share in the marine insurance industry.

- Traders remain a dominant segment in the market due to their valuable commodities and high-value goods while trading internationally, traders need comprehensive marine insurance.

- The increasing regulatory requirements in the shipping industry, which compel shipping companies to secure comprehensive insurance coverage to comply with international laws, are supporting the market growth.

- Apart from this, the rising trend of e-commerce has boosted demand for marine cargo insurance to protect the vast volumes of goods being transported globally through maritime channels.

Request to Get the Sample Report: https://www.imarcgroup.com/marine-insurance-market/requestsample

Industry Trends and Drivers:

- The Growth of Global Trade and Maritime Activities:

The growth of global trade and maritime activities is a significant driver of the marine insurance market. As international trade continues to expand, fueled by the demand for goods and raw materials, the shipping and logistics industry has experienced a corresponding rise in activities. Maritime transport remains the most cost-effective and efficient method for transporting bulk goods across long distances, accounting for approximately 80% of global trade by volume.

This increase in shipping traffic, combined with the growing complexity of global supply chains, has heightened the need for marine insurance to protect cargo, ships, and shipping companies from potential losses. The expanding use of containerization, larger vessels, and more complex shipping routes has introduced new risks, further contributing to the market expansion.

- Increasing Exposure to Natural Disasters and Geopolitical Risks:

Climate change has led to a rise in the frequency and intensity of extreme weather events, such as hurricanes, cyclones, and storms, which pose significant risks to maritime operations. Ships, ports, and cargo are more vulnerable to damage, and the unpredictability of these events has increased the need for insurance coverage to protect against potential losses.

Moreover, geopolitical tensions in regions with major shipping routes, such as the South China Sea and the Persian Gulf, have raised concerns about piracy, political instability, and armed conflicts. These risks can disrupt shipping operations, cause delays, and lead to loss or damage of goods. Marine insurance provides coverage for such risks, ensuring that businesses involved in maritime trade are aiding the market growth.

- Advancements in Digital Technologies for Risk Management:

Advancements in digital technologies for risk management are another important factor driving the marine insurance market. The introduction of technologies like blockchain, artificial intelligence (AI), and big data analytics has transformed the insurance industry, making it easier for companies to assess risks, streamline claims processing, and improve transparency.

For instance, blockchain technology can be used to create secure, transparent records of shipments and insurance contracts, reducing the potential for fraud and disputes. Artificial intelligence (AI) and data analytics enable insurers to analyze large amounts of data to predict potential risks and offer more accurate pricing models thereby providing an impetus to the market growth.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=4690&flag=C

Marine Insurance Market Report Segmentation:

Breakup By Type:

- Cargo Insurance

- Hull and Machinery Insurance

- Marine Liability Insurance

- Offshore/Energy Insurance

Cargo insurance accounts for the majority of shares as it provides crucial coverage for goods in transit, protecting against common risks like loss, theft, or damage.

Breakup By Distribution Channel:

- Wholesalers

- Retail Brokers

- Others

Wholesalers dominate the market due to their ability to offer tailored marine insurance packages and act as intermediaries for smaller brokers and agents.

Breakup By End User:

- Ship Owners

- Traders

- Others

Traders hold the majority of shares as they require extensive marine insurance to safeguard their high-value goods and commodities across global trade routes.

Breakup By Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe holds the leading position due to its long-established shipping industry, numerous major ports, and robust regulatory framework governing maritime insurance.

Top Marine Insurance Market Leaders: The marine insurance market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

- Allianz SE

- American International Group Inc.

- Aon plc

- Arthur J. Gallagher & Co.

- AXA S.A

- Beazley plc

- Brown & Brown Inc.

- Chubb Group Holdings Inc

- Lloyd's of London

- Lockton Companies

- Marsh & McLennan Companies Inc.

- QBE Insurance Group Ltd

- Swiss Re Ltd

- Willis Towers Watson plc

- Zurich Insurance Group Ltd.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1–631–791–1145

businessnews

businessnews