UK Contactless Payments Market Size, Share, Growth and Report 2024-2032

The growing preferences for convenient and speedy payment options among individuals, rising use of mobile wallets and digital payment apps, and increasing adoption of wearable technology, such as smartwatches and fitness trackers, are some of the factors impelling the UK contactless payments market growth.

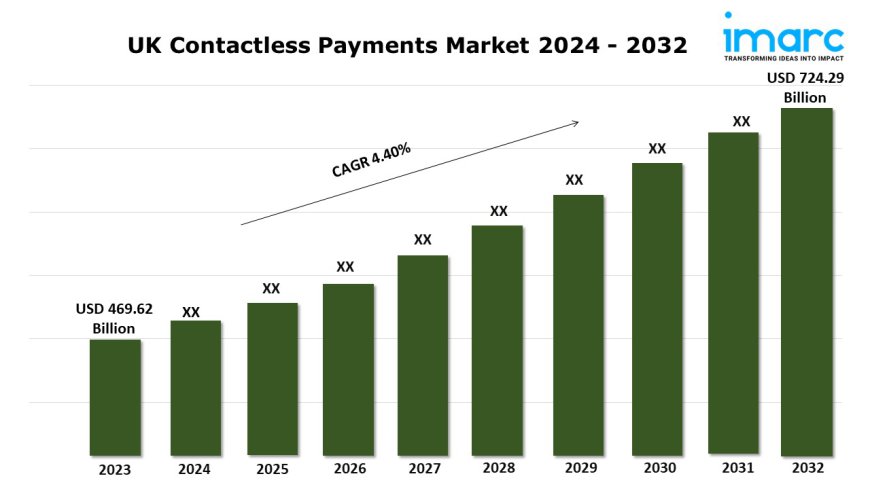

UK Contactless Payments Market Outlook

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Size in 2023: USD 469.62 Billion

Market Forecast in 2032: USD 724.29 Billion

Market Growth Rate: 4.40% (2024-2032)

The UK contactless payments market size was valued at USD 469.62 Billion in 2023 and is projected to grow to USD 724.29 Billion by 2032, with an expected compound annual growth rate (CAGR) of 4.40% from 2024 to 2032.

UK Contactless Payments Market Trends:

The UK contactless payments market has undergone such rapid growth, driven by a number of pivotal factors. Increasing consumer preference for ease and swiftness is fuelling the adoption of contactless technology. Contactless payments allow for relatively rapid transactions, thus reducing waiting time both in retail as well as on public transport, which has resulted in their acceptance by the majority. Another factor is technology development, which has enabled the use of contactless payments via NFC-enabled mobile phones and smart wearables.

The increase in the contactless payment limit has further encouraged take-up as this enables transactions with an initial cash value above the existing maximum that does not require a PIN to be inputted. Strong backing from financial institutions and retailers, coupled with substantial investment in further payment infrastructure development, were also significant factors. Additionally, as the digital wallets take market share, they provide customers with a better experience, thus promoting broader adoption.

Request Free Sample Report: https://www.imarcgroup.com/uk-contactless-payments-market/requestsample

UK Contactless Payments Market Scope and Growth Analysis:

The UK contactless payments market spreads across a myriad of payment methods such as contactless credit, debit cards, mobile wallets, and wearable payment devices. The scope of it encompasses virtually all sectors including retail, public transport, foods, and entertainment, thus considered as one of the cornerstones of the digital economy in the country. The market is characterized by high penetration with practically all UK adults owning at least one contactless-enabled payment option. The retail market remains the dominant sector, propelled by rapid adoption on the part of supermarkets, convenience stores, and hospitality shops. Next, the public transportation sector is another significant contributor, with contactless services in play; for instance, the London Underground systems which integrate contactless technology into travel systems.

The global payment processors, financial institutions, and tech giants lead the competition in this space, maintaining continuous innovation in the segment. Mobile wallets are gaining traction thanks to their easy-to-use interfaces and additional security features. The major trends characterizing this market include biometric authentication, AI technology to detect fraud, and the rise of open banking to create smooth penetration from this sector. With increasing preferences toward cashless transactions, the momentum of the UK contactless payments market is steadily growing, supported by technological advancement and regulatory approvals and consumer habits.

UK Contactless Payments Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest UK contactless payments market share. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Type Insights:

- Smartphone Based Payments

- Card Based Payments

- Credit Cards

- Debit Cards

- Others

Application Insights:

- Retail

- Consumer Electronics

- Fashion & Garments

- Others

- Transportation

- Healthcare

- Hospitality

- Others

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst For Customization: https://www.imarcgroup.com/request?type=report&id=24938&flag=C

Other Key Points Covered in the Report:

- COVID-19 Impact on the Market

- Porter's Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145