UK Fintech Market Analysis, Share, Size, Industry Trends and Growth Report 2024-2032

A supportive regulatory environment, high digital adoption rates, strong government support, a thriving startup ecosystem, ample venture capital investment, availability of a skilled workforce, shifting focus on cybersecurity, and partnerships between traditional banks and fintech firms are some of the factors driving the UK fintech market growth.

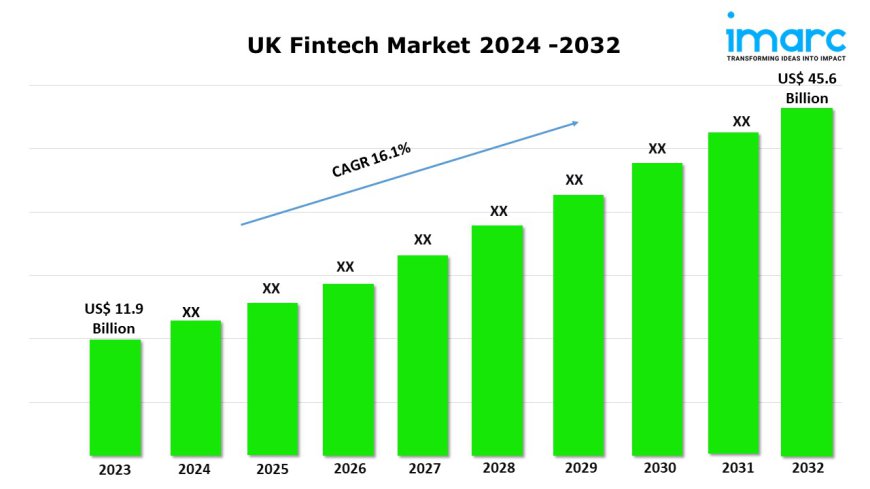

UK Fintech Market Outlook

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Size in 2023: USD 11.9 Billion

Market Forecast in 2032: USD 45.6 Billion

Market Growth Rate: 16.1% (2024-2032)

The UK fintech market size was valued at USD 11.9 Billion in 2023 and is projected to grow to USD 45.6 Billion by 2032, with an expected compound annual growth rate (CAGR) of 16.1% from 2024 to 2032.

UK Fintech Market Trends:

The UK fintech market is propelled by a blend of strong regulatory support, advanced digital infrastructure, and a dynamic startup ecosystem that fosters innovation. The sector benefits significantly from government initiatives and policies aimed at promoting financial technology, including tax incentives and regulatory sandboxes that facilitate innovation and compliance. The proliferation of smartphone usage and high internet penetration contribute to the widespread adoption of fintech solutions, making digital financial services more accessible. Additionally, the shift towards cashless transactions and the increasing demand for real-time, personalized financial services fuel market growth.

Strategic investments and venture capital funding have further enhanced the development of disruptive technologies such as blockchain, artificial intelligence (AI), and machine learning (ML), empowering new business models and product offerings. Consumer preferences for convenient, user-centric banking experiences have driven the uptake of mobile banking and payment solutions. Moreover, collaborations between traditional financial institutions and fintech companies have strengthened product portfolios, improving efficiency and customer satisfaction. These factors, combined with a growing emphasis on cybersecurity solutions, position the UK fintech market for sustained growth.

For an in-depth analysis, you can refer free sample copy of the report: https://www.imarcgroup.com/uk-fintech-market/requestsample

UK Fintech Market Scope and Growth Analysis:

The UK market showcases extensive scope, encompassing a variety of financial services including digital banking, online lending, wealth management, and insurance technology (insurtech). The sector’s growth is marked by the seamless integration of cutting-edge technologies into financial operations, improving accessibility and affordability. Continuous advancements in AI-driven data analytics and robotic process automation (RPA) are redefining customer service experiences and operational efficiencies. The rise of embedded finance, which integrates financial services into non-financial platforms, is broadening the fintech ecosystem and reaching previously untapped customer bases.

Additionally, the expansion of cross-border payment solutions and international fintech partnerships enhances the market’s global competitiveness. Increasing regulatory attention to data privacy and open banking initiatives is encouraging transparency and user control over financial data, fostering trust and adoption. The growth trajectory is further bolstered by digital transformation strategies across various industries that prioritize seamless, tech-driven financial solutions. As traditional banks and new entrants compete and collaborate, the market is changing, offering comprehensive and specialized financial products tailored to modern consumer needs.

IMARCs report provides a deep dive into the UK fintech market analysis, outlining the current trends, underlying market demand, and growth trajectories.

UK Fintech Market Forecast and Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest UK fintech market share. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Deployment Mode Insights:

- On-premises

- Cloud-based

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

End User Insights:

- Banking

- Insurance

- Securities

- Others

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst For Customization: https://www.imarcgroup.com/request?type=report&id=22071&flag=C

Other key areas covered in the report:

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145