Fiberglass Market Analysis, Trends & Forecast 2024 to 2032

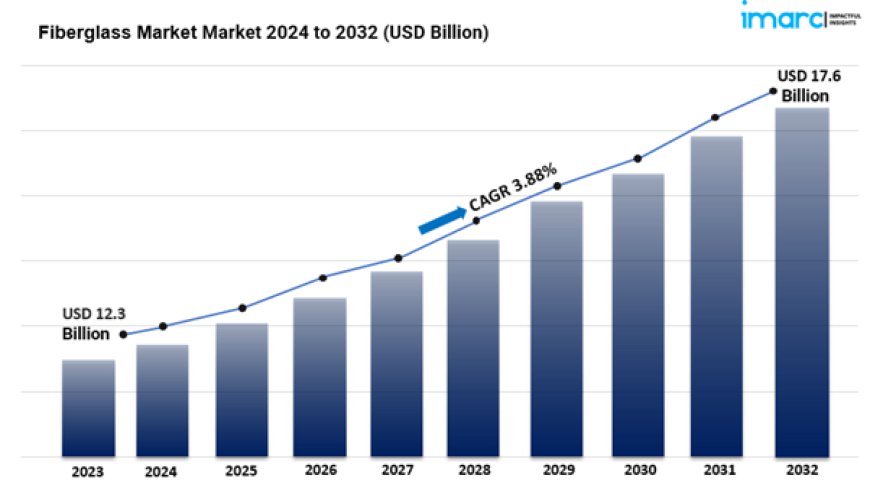

The global fiberglass market size reached USD 12.3 Billion in 2023 the market size is expected to reach USD 17.6 Billion by 2032, exhibiting a growth rate (CAGR) of 3.88% during 2024-2032.

Fiberglass Market Size 2024 To 2032

- The global fiberglass market size reached USD 12.3 Billion in 2023.

- The fiberglass market size is expected to reach USD 17.6 Billion by 2032, exhibiting a growth rate (CAGR) of 3.88% during 2024-2032.

- Direct and assembled roving leads the market, accounting for most of the market share owing to its high durability and use in reinforcement applications.

- E-glass represents the largest segment due to its cost-effectiveness and broad applicability across multiple industries.

- Composites represent the leading application segment spurred by their adaptability in manufacturing lightweight, high-performance components.

- Automotive holds the largest share in the fiberglass industry, driven by growing demand for lightweight materials in vehicle production.

- Asia Pacific leads the market with its expanding manufacturing base and increasing construction activities.

- The growth of the fiberglass market is driven by increasing demand for corrosion-resistant materials in industries such as chemical processing, marine, and oil & gas.

- Moreover, government initiatives promoting sustainable and energy-efficient construction are bolstering the adoption of fiberglass products globally.

Request to Get the Sample Report:

https://www.imarcgroup.com/fiberglass-market/requestsample

Industry Trends and Drivers:

· Rising demand from the construction industry:

Fiberglass is extensively used in the construction sector due to its exceptional properties such as high strength, lightweight nature, and resistance to corrosion, heat, and chemical damage. It is often employed in roofing, insulation, and reinforcement materials, making it a crucial component in modern building projects. As urbanization and infrastructure development continue to accelerate, particularly in emerging economies, the demand for durable and efficient building materials like fiberglass is increasing.

Moreover, the trend toward green and sustainable construction further fuels the adoption of fiberglass, as it is often considered an eco-friendlier alternative to traditional materials. The material's energy-saving properties, especially when used in insulation, make it an attractive option for both residential and commercial buildings striving to meet stricter environmental regulations.

· Expanding applications in automotive and transportation:

The automotive and transportation sectors are increasingly integrating fiberglass materials due to their ability to reduce vehicle weight without compromising strength. Fiberglass composites are commonly used in manufacturing automotive body panels, structural components, and interior parts. The push for lighter vehicles to improve fuel efficiency and reduce emissions has made fiberglass a go-to material for car manufacturers. With the rise of electric vehicles (EVs), which require lightweight materials to enhance battery performance and extend range, the use of fiberglass is further driven by this emerging trend.

Additionally, fiberglass is finding applications in other transportation areas, such as aerospace and railways, where its high strength-to-weight ratio is highly beneficial.

· Growing utilization in wind energy infrastructure:

Fiberglass plays a critical role in the production of wind turbine blades, where its high tensile strength and fatigue resistance are crucial for ensuring the durability and efficiency of wind turbines. As the global shift towards renewable energy intensifies, investments in wind energy infrastructure are surging. Countries worldwide are expanding their wind energy capacity to meet renewable energy goals, leading to a significant rise in the demand for fiberglass. The material's adaptability and performance in extreme weather conditions make it ideal for this application, thus driving its consumption in the energy sector.

Fiberglass Market Report Segmentation:

Breakup By Glass Product Type:

· Glass Wool

· Direct and Assembled Roving

· Yarn

· Chopped Strand

· Others

Direct and assembled roving are widely used in construction and automotive applications due to their superior strength, versatility, and easy processing.

Breakup By Glass Fiber Type:

· E-Glass

· A-Glass

· S-Glass

· AR-Glass

· C-Glass

· R-Glass

· Others

E-glass is preferred for its excellent insulation, high strength, and corrosion resistance, making it suitable for diverse industries like construction, automotive, and electronics.

Breakup By Resin Type:

· Thermoset Resin

· Thermoplastic Resin

Based on the application, the market is categorized into thermoset and thermoplastic resin.

Breakup By Application:

· Composites

· Insulation

Fiberglass composites are favored for their lightweight, high-strength properties, making them ideal for construction, automotive, and aerospace applications.

Breakup By End User:

· Construction

· Automotive

· Wind Energy

· Aerospace and Defense

· Electronics

· Others

Automotive manufacturers increasingly use fiberglass for its lightweight and fuel efficiency benefits, particularly in body panels, interiors, and structural components.

Breakup By Region:

· Asia Pacific

· North America

· Europe

· Latin America

· Middle East and Africa

Asia Pacific is the largest market for fiberglass due to rapid industrialization, urbanization, and growing infrastructure projects in countries like China and India.

Top Fiberglass Market Leaders:

The fiberglass market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

· Asahi Fiber Glass Co. Ltd. (Yoshino Gypsum Co. Ltd.)

· Braj Binani Group

· China Jushi Co. Ltd.

· Chongqing Polycomp International Corp. (Yuntianhua Group Co. Ltd.)

· Compagnie De Saint-Gobain S.A.

· Johns Manville (Berkshire Hathaway Inc.)

· Knauf Insulation

· Nippon Electric Glass Co. Ltd.

· Owens Corning

· PFG Fiber Glass Corporation (Nan Ya Plastics Corporation)

· Taishan Fiberglass Inc (Sinoma Science & Technology Co. Ltd.)

· Taiwan Glass Industry Corporation

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=3498&flag=C

Key Highlights of the Report:

· Market Performance (2018-2023)

· Market Outlook (2024-2032)

· Market Trends

· Market Drivers and Success Factors

· Impact of COVID-19

· Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: sales@imarcgroup.com

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800

marketresearch

marketresearch