India Real Estate Market Size in India and Industry Overview 2026-2034 | Get Sample Report

According to IMARC Group’s latest report titled "India Real Estate Market Size, Share, Trends and Forecast by Property, Business, Mode, and Region, 2026-2034", this study offers a granular analysis of the sector's monumental shift towards organized development and digital integration. The study offers a profound analysis of the industry, encompassing real estate market size in india, growth rate, share, size, key trends, and regional insights. The report covers critical market dynamics, including the impact of RERA on transparency, the structural premiumization of residential demand, and the rising influence of PropTech in streamlining property transactions.

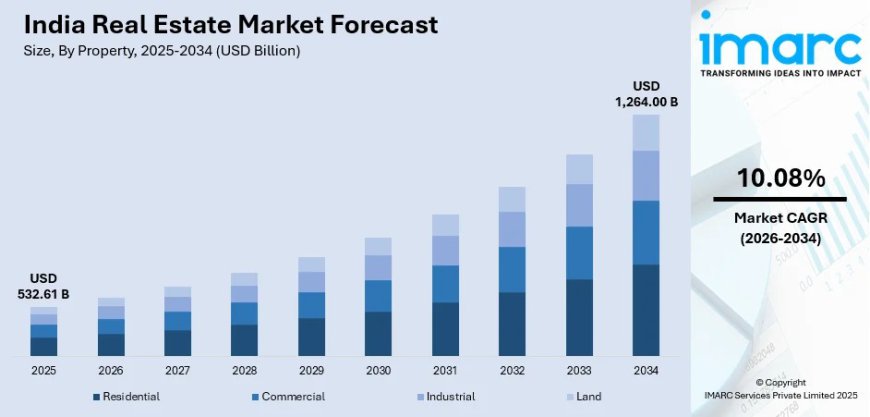

Market At-A-Glance: Key Statistics (2026-2034):

- Current Market Size (2025): USD 532.61 Billion

- Projected Market Size (2034): USD 1,264.00 Billion

- Growth Rate (CAGR): 10.08%

- Dominant Region: West and Central India (Implicit from the high volume of premium developments in Mumbai and Pune)

Request Free Sample Report (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/india-real-estate-market/requestsample

India Real Estate Market Overview

The India real estate market size was valued at USD 532.61 Billion in 2025 and is projected to reach USD 1,264.00 Billion by 2034, growing at a compound annual growth rate of 10.08% from 2026-2034.

The market is witnessing a structural transformation, primarily driven by rapid urbanization and a rising middle-class population aspiring for homeownership. The residential sector, which dominates the market, is experiencing a decisive shift towards premium and luxury housing, outpacing affordable segments in major metros. Simultaneously, the commercial sector is being fueled by the expansion of Global Capability Centers (GCCs) and the return-to-office trend, driving demand for Grade-A office spaces. The industry is also pivoting towards digitization, with online property portals and virtual tours becoming standard, enhancing market transparency. Furthermore, significant infrastructure projects like new metro lines and expressways are unlocking new micro-markets in peripheral urban areas.

Top Emerging Trends in the India Real Estate Market:

- Rising Demand for Rental Housing and Managed Living Spaces: Urban migration, student populations, and young professionals are increasing demand for rental housing, co-living, and professionally managed residential properties across major cities.

- Increasing Focus on Asset Monetization by Developers: Developers are monetizing land banks and completed assets through joint ventures, asset sales, and phased developments to improve liquidity and reduce balance sheet pressure.

- Growing Adoption of Construction Technology and Prefab Methods: Real estate developers are adopting prefabrication, modular construction, and project management technologies to reduce construction timelines and improve cost efficiency.

- Higher Emphasis on Compliance-Led Project Launches: Developers are prioritizing legally compliant, RERA-approved projects to rebuild buyer trust and improve sales velocity.

- Rising Demand for Mixed-Use Real Estate Developments: Integrated residential, retail, and office developments are gaining popularity due to convenience, optimized land usage, and higher long-term asset value.

India Real Estate Market Growth Factors (Drivers)

- Rising Migration Toward Urban Employment Centers: Continuous migration toward employment hubs is driving sustained demand for housing, rental accommodation, and urban real estate infrastructure.

- Formalization of Real Estate Financing Ecosystem: Increased participation from banks, NBFCs, and structured financing solutions is improving funding availability for developers and buyers.

- Growth of Manufacturing and Industrial Corridors: Industrial corridors and manufacturing clusters are generating demand for residential, logistics, and commercial real estate nearby.

- Improving Transparency and Buyer Confidence Levels: Regulatory reforms and digital property records are enhancing transparency, reducing fraud risks, and encouraging buyer participation.

- Long-Term Real Estate Demand from Economic Expansion: India’s economic growth, rising employment, and income generation are supporting sustained real estate demand across asset classes.

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/india-real-estate-market

Market Segmentation

Analysis by Property:

- Residential (Dominant segment, accounting for ~79% of the market)

- Commercial (Office spaces, Retail)

- Industrial (Warehousing, Logistics parks)

- Land

The residential segment holds a dominant 78.8% market share in 2025, supported by rapid urbanization, government housing initiatives, and rising demand for affordable as well as premium homes across metro and tier II cities.

Analysis by Business:

- Sales (Leading segment driven by end-user demand)

- Rental

The sales segment leads with a 70.0% share in 2025, driven by strong end-user demand and sustained investor interest in real estate as a long-term capital appreciation asset.

Analysis by Mode:

- Offline (Traditionally dominant for final transactions)

- Online (Fastest growing for discovery and initial stages)

Offline transactions account for the largest share at 84.2% in 2025, reflecting buyer preference for physical property inspections, direct dealer engagement, and conventional transaction processes.

Regional Insights:

- West and Central India: The largest market share holder, driven by the high-value property market in the Mumbai Metropolitan Region (MMR) and Pune.

- South India: Strong growth in Bangalore, Hyderabad, and Chennai fueled by the IT/ITeS sector.

- North India: Significant activity in NCR (Delhi, Gurgaon, Noida).

- East India: Emerging growth in Kolkata and Bhubaneswar.

West and Central India dominate with a 32.0% market share in 2025, fueled by major urban centers such as Mumbai, Pune, and Ahmedabad, alongside strong economic and infrastructure activity.

India Real Estate Market Recent Developments & News

- 2026 Land Deals: The Mumbai Metropolitan Region (MMR) emerged as the most active market, closing 32 land deals covering over 500 acres in 2026.

- Sales Surge: Housing sales surged by 15% in southern cities (Bengaluru, Hyderabad, Chennai) in 2026, signaling strong regional momentum.

- Policy Push: The government’s increased budget allocation for PMAY in 2025-25 aims to construct 3 crore additional rural and urban houses.

Why Buy This Report? (High-Value Insights)

- Granular Segmentation: Detailed analysis of Residential vs. Commercial yield trends, helping investors identify high-ROI assets.

- Regional Hotspots: In-depth breakdown of demand in MMR vs. NCR, aiding developers in land acquisition strategies.

- Future-Ready Trends: Insights into the rise of Fractional Ownership and SM REITs, highlighting new investment avenues for retail investors.

Key Highlights of the Report

- Market Forecast (2026-2034): Quantitative data on market value and double-digit growth.

- Competitive Landscape: Comprehensive analysis of key developers and their launch pipelines.

- Strategic Analysis: Porter’s Five Forces analysis and SWOT assessment.

- Technological Trends: Insights into the role of 3D printing in construction speed and cost reduction.

Get Your Customized Market Report Instantly: https://www.imarcgroup.com/request?type=report&id=5495&flag=E

Customization Note: If you require specific data we can provide it as part of our customization services.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-202071-6302