Two Wheeler Market Share in India and Industry Overview 2026-2034 | Get Sample Report

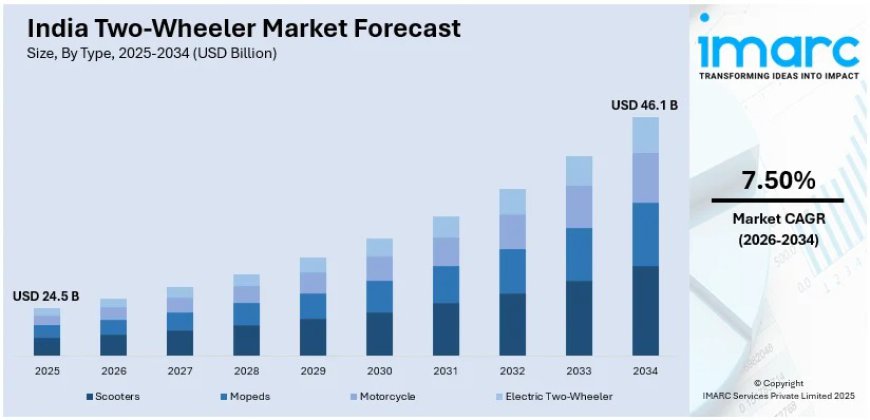

According to IMARC Group's report titled "India Two-Wheeler Market Size, Share, Trends and Forecast by Type, Technology, Transmission, Engine Capacity, Fuel Type, End User, Distribution Channel, and Region, 2026-2034", The report offers a comprehensive analysis of the industry, including India two wheeler market forecast, growth, two wheeler market share in india, and regional insights.

How Big is the India Two-Wheeler Industry ?

The India two wheeler market size was valued at 28.8 Million Units in 2025 and is projected to grow to 101.4 Million Units by 2034, with an expected compound annual growth rate (CAGR) of 15.01% from 2026 to 2034.

Download Free Sample (PDF + Forecast Excel): https://www.imarcgroup.com/india-two-wheeler-market/requestsample

India Two-Wheeler Market Trends:

- Strong Preference for Fuel-Efficient and Low-Maintenance Models: Consumers increasingly prioritize mileage, durability, and affordable servicing, driving demand for commuter-focused motorcycles and scooters suited for daily urban and rural transportation needs.

- Premiumization Through Design, Features, and Technology Integration: Manufacturers are introducing advanced styling, digital instrument clusters, Bluetooth connectivity, riding modes, and enhanced safety features to attract aspirational and younger buyers.

- Gradual Shift Toward Electric and Alternative Powertrain Options: Electric two-wheelers are gaining visibility in urban markets due to lower operating costs, supportive policies, and improving charging infrastructure availability.

- Expansion of Digital Sales, Bookings, and Ownership Platforms: OEMs and dealers are strengthening online bookings, virtual showrooms, and app-based after-sales services to improve customer engagement and convenience.

- Faster Model Refresh Cycles and Variant Proliferation: Companies are launching frequent updates and multiple variants to address diverse pricing bands, usage needs, and evolving consumer preferences.

India Two-Wheeler Market Scope and Growth Analysis:

- High Dependence on Two-Wheelers for Affordable Personal Mobility: Two-wheelers remain the most economical and flexible mobility option across urban, semi-urban, and rural regions, supporting sustained demand.

- Improved Financing Accessibility and First-Time Buyer Credit: Easy EMIs, low down payments, and digital loan approvals are expanding affordability for students, gig workers, and first-time vehicle buyers.

- Rural Income Stability and Agricultural Activity Growth: Stable farm incomes and rural economic activity are supporting consistent two-wheeler demand for mobility and utility purposes.

- Expansion of Delivery, Gig Economy, and Shared Mobility Services: Growth of food delivery, e-commerce logistics, and ride services is increasing demand for durable, fuel-efficient two-wheelers.

- Extensive Service Networks and Low Total Ownership Costs: Wide service coverage, affordable spare parts, and low maintenance costs continue to favor two-wheeler adoption nationwide.

By the IMARC Group, the Top Competitive Landscapes Operating in the Industry:

- Bajaj Auto Limited

- Hero MotoCorp Ltd

- Honda Motorcycle and Scooter India Pvt. Ltd.

- India YAMAHA Motor Pvt. Ltd

- Royal Enfield

- Suzuki Motorcycle India

- TVS Motor Company

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/india-two-wheeler-market

India Two-Wheeler Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest India two-wheeler market share. It includes forecasts for the period 2026-2034 and historical data from 2020-2025 for the following segments.

Analysis by Type:

- Motorcycle (Dominant segment with 56% share)

- Scooters

- Mopeds

- Electric Two-Wheeler

Motorcycles dominate the market with a 56% share in 2025, supported by their versatility for both urban and long-distance travel, affordability, and strong preference among budget-conscious middle- and lower-income consumers nationwide.

Analysis by Technology:

- ICE (Leading with 90% share due to established infrastructure)

- Electric

Internal combustion engine (ICE) vehicles account for 90% of the market in 2025, driven by well-established refueling infrastructure, consumer familiarity, lower upfront costs, and extensive service networks across urban and rural regions.

Analysis by Transmission:

- Manual (Largest segment with 78% share)

- Automatic

Manual transmission leads with a 78% market share in 2025, reflecting consumer preference for better fuel efficiency, lower maintenance expenses, greater riding control, and cost-effective commuting solutions.

Analysis by Engine Capacity:

- 100-125cc (Dominant with 42% share due to fuel economy balance)

- <100cc

- 126-150cc

- 151-200cc

- 201-500cc

- 500cc

The 100–125cc segment holds a 42% share in 2025, owing to its optimal balance of fuel efficiency and adequate power, making it suitable for daily commuting in congested cities and longer rural routes.

Analysis by Fuel Type:

- Petrol (Leading with 47% share)

- Electric

- Others

Petrol-powered vehicles dominate with a 47% share in 2025, supported by widespread fuel availability, mature supply chains, competitive pricing, and high consumer confidence in conventional fuel options.

Analysis by End User:

- Personal (Dominant with 94% share)

- Commercial

Personal usage accounts for 94% of the market in 2025, driven by rising demand for individual mobility, urban traffic congestion, limited public transport, and growing ownership aspirations among young professionals.

Analysis by Distribution Channel:

- Offline (Dominant with 89% share)

- Online

Offline channels lead with an 89% market share in 2025, as consumers continue to value physical inspection, test rides, assured after-sales service, and personalized dealer engagement.

Regional Insights:

- West and Central India: Leading market (34% share) driven by favorable economic conditions and major metro populations.

- North India

- South India

- East India

West and Central India hold the largest share at 34% in 2025, fueled by dense metropolitan populations, industrial expansion, favorable economic conditions, and increasing purchasing power driving private vehicle adoption.

Ask Analyst For Customization: https://www.imarcgroup.com/request?type=report&id=3991&flag=E

Other key areas covered in the report:

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-202071-6302