Anhydrous Hydrofluoric Acid Prices: Latest Market Trends, Supply Dynamics, and Forecast Outlook

The Anhydrous Hydrofluoric Acid Prices market has gained significant attention in the global chemical industry due to its crucial role in fluorochemicals, refrigerants, semiconductors, and aluminum processing

The Anhydrous Hydrofluoric Acid Prices market has gained significant attention in the global chemical industry due to its crucial role in fluorochemicals, refrigerants, semiconductors, and aluminum processing. As we move into 2026, the latest market data indicates that pricing trends are being influenced by feedstock costs, supply chain disruptions, downstream demand patterns, and regional industrial activity.

Anhydrous Hydrofluoric Acid (AHF) is a key raw material produced primarily from fluorspar (calcium fluoride) and sulfuric acid. Its importance in high-growth sectors such as electronics manufacturing and advanced materials has made pricing highly sensitive to supply-demand fluctuations worldwide.

Market Overview of Anhydrous Hydrofluoric Acid

Anhydrous Hydrofluoric Acid is a highly corrosive inorganic chemical widely used in manufacturing fluoropolymers, refrigerants, aluminum fluoride, and specialty chemicals. The production process involves reacting fluorspar with concentrated sulfuric acid at high temperatures. It is also obtained as a by-product during phosphoric acid production.

Its applications include:

-

Fluorochemicals and refrigerants

-

Semiconductor etching processes

-

Aluminum refining and metal treatment

-

Glass etching and cleaning agents

-

Oil refining

Because of its diverse industrial uses, Anhydrous Hydrofluoric Acid Prices Trends often reflect broader industrial performance across chemical, electronics, and manufacturing sectors.

Latest Global Price Trends (2025–2026)

North America

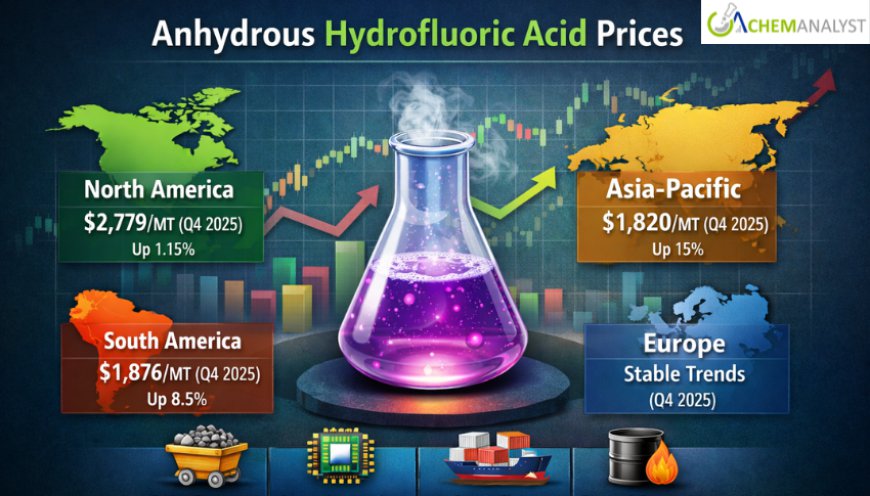

In the United States, prices showed moderate growth in late 2025, rising around 1.15% quarter-over-quarter. The average price during the quarter ending December 2025 was approximately USD 2,779/MT, supported by import constraints and steady downstream demand.

Key factors influencing price movement included:

-

Higher fluorspar feedstock costs

-

Import logistics delays

-

Steady consumption from semiconductor and refrigerant sectors

Despite adequate inventories, delays in vessel arrivals tightened spot availability, leading to slight upward price adjustments.

Asia-Pacific

The Asia-Pacific region, particularly Japan, experienced significant price growth during Q4 2025. Prices increased by more than 15% quarter-over-quarter, reaching approximately USD 1,820/MT.

This strong upward movement was driven by:

-

Tight import supply

-

Rising demand from semiconductor fabrication plants

-

Increased feedstock costs

-

Export-driven domestic supply tightening

The electronics industry remains a major driver of Anhydrous Hydrofluoric Acid Prices in Asia due to its use in chip manufacturing.

Europe

European prices remained relatively stable with mixed trends. Early-quarter firmness from industrial demand was followed by mid-quarter softening due to improved inventories.

Factors influencing the European market:

-

Stable raw material costs

-

Balanced supply-demand conditions

-

Moderate demand from fluorochemical industries

However, year-end restocking by manufacturers supported a slight price increase toward late 2025.

South America

In Brazil, prices rose approximately 8.5% quarter-over-quarter in late 2025, averaging around USD 1,876/MT.

Price changes were influenced by:

-

Tight feedstock availability

-

Import parity pricing

-

Strong demand from aluminum and agrochemical industries

However, adequate inventories and cautious buyer behavior limited sharp price increases.

Track Real Time Price Of Anhydrous Hydrofluoric Acid

https://www.chemanalyst.com/ChemAnalyst/PricingForm?Product=Anhydrous%20Hydrofluoric%20Acid

Key Market Drivers Affecting Prices

1. Feedstock Costs

Fluorspar is the primary raw material used in AHF production. Any fluctuation in fluorspar mining supply or export restrictions directly impacts Anhydrous Hydrofluoric Acid Prices Trends.

Rising sulfuric acid prices also contribute to higher production costs.

2. Supply Chain Constraints

Global logistics disruptions, port congestion, and freight volatility have affected import availability, particularly in North America and Asia.

Supply tightness from delayed shipments has frequently led to temporary price increases.

3. Downstream Demand

Demand from key sectors plays a critical role in price movements:

-

Refrigerant production

-

Semiconductor manufacturing

-

Aluminum processing

-

Specialty chemical production

Strong semiconductor industry activity has recently supported price growth, particularly in Asia-Pacific markets.

4. Energy and Production Costs

Energy costs remain a major factor affecting AHF production economics. Stable energy prices have helped maintain balanced market conditions in Europe.

Regional Demand Analysis

Semiconductor Sector Growth

The semiconductor industry has emerged as one of the strongest drivers of Anhydrous Hydrofluoric Acid Prices globally. AHF is essential for wafer etching processes used in chip manufacturing.

Increased fabrication capacity and advanced chip production have led to rising demand for high-purity hydrofluoric acid.

Refrigerant Industry

The transition toward environmentally friendly refrigerants has increased the need for fluorochemicals, thereby boosting AHF consumption.

Seasonal demand patterns in the refrigerant industry often lead to periodic price fluctuations.

Aluminum Industry

AHF is widely used in aluminum fluoride production, a critical material for aluminum smelting. Growth in construction and automotive industries supports demand from this sector.

Supply Landscape

Major global producers include:

-

Honeywell International

-

Solvay

-

Daikin Industries

-

Stella Chemifa Corporation

These companies maintain significant production capacities and influence global supply availability.

Production levels often depend on fluorspar mining output, environmental regulations, and energy costs.

Market Challenges

Raw Material Scarcity

Limited fluorspar mining capacity and regulatory restrictions have constrained raw material availability in several regions.

Environmental Regulations

Strict environmental policies governing mining and chemical production have increased compliance costs for manufacturers.

Trade and Logistics Risks

Global shipping delays and geopolitical tensions continue to create uncertainty in supply chains.

Price Forecast Outlook for 2026

Looking ahead to 2026, the global outlook for Anhydrous Hydrofluoric Acid Price Index remains moderately positive.

Expected market trends include:

-

Continued upward pressure from feedstock costs

-

Strong demand from semiconductor and electronics sectors

-

Stable consumption in refrigerant and fluorochemical industries

-

Moderate supply constraints due to limited fluorspar mining

Overall, prices are expected to remain range-bound with gradual growth potential, particularly in regions with strong industrial expansion.

Future Opportunities

Expansion in Electronics Manufacturing

Growing global demand for semiconductors and advanced electronics will continue to support AHF consumption.

Green Refrigerant Transition

Environmental regulations promoting low-GWP refrigerants will increase fluorochemical demand, supporting price growth.

Emerging Market Demand

Rapid industrialization in developing economies is expected to create new growth opportunities for AHF suppliers.

Conclusion

The Anhydrous Hydrofluoric Acid Prices market is strongly influenced by feedstock availability, downstream industrial demand, and global supply chain dynamics. Recent data indicates stable to moderately rising prices driven by fluorspar constraints, semiconductor industry growth, and steady consumption from refrigerant and chemical sectors.

As we move into 2026, the latest market outlook suggests a balanced yet firm pricing environment, with gradual upward trends expected due to sustained industrial demand and supply limitations. Companies involved in production and procurement should closely monitor feedstock supply conditions, logistics developments, and downstream industry performance to effectively navigate market volatility.

cheminfo

cheminfo