India Security Market Share and Outlook 2026-2034 | Get Sample Report

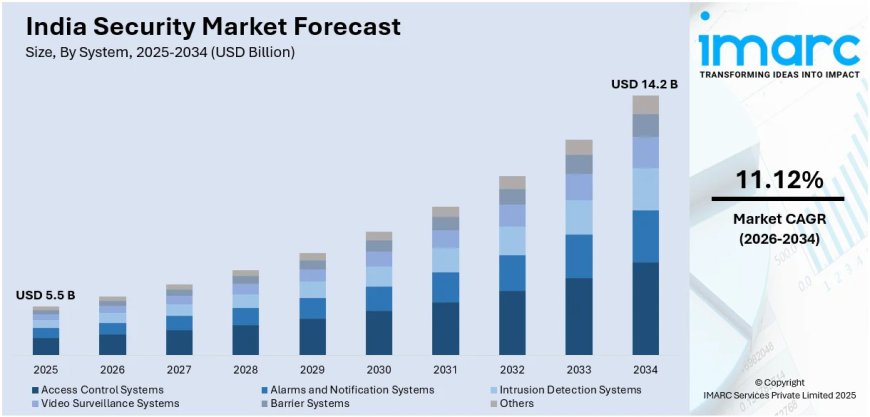

The India security market size reached USD 5.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 14.2 Billion by 2034, exhibiting a robust growth rate (CAGR) of 11.12% during 2026-2034.

Source: IMARC Group | Category: Technology & Media

Report Introduction

According to IMARC Group’s latest report titled "India Security Market Size, Share, Trends and Forecast by System, Service, End User, and Region, 2026-2034", this study offers a granular analysis of the country's evolving defense, cybersecurity, and physical security landscape. The study offers a profound analysis of the industry, encompassing India security market size, India security market share analysis, India security market trends, and regional insights. The report covers critical market dynamics, including the impact of the Make in India initiative on defense manufacturing, the rising adoption of AI in surveillance, and the expanding cybersecurity infrastructure to counter digital threats.

Market At-A-Glance: Key Statistics (2026-2034):

- Current Market Size (2025): USD 5.5 Billion

- Projected Market Size (2034): USD 14.2 Billion

- Growth Rate (CAGR): 11.12%

- Dominant Region: South India (Implicit from the concentration of IT/Cybersecurity hubs like Bengaluru)

Request Free Sample Report (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/india-security-market/requestsample

India Security Market Overview

The India security market size reached USD 5.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 14.2 Billion by 2034, exhibiting a robust growth rate (CAGR) of 11.12% during 2026-2034.

The market is witnessing a structural shift, primarily driven by heightened geopolitical tensions and the rapid digitalization of critical infrastructure. The government's focus on modernizing the armed forces through indigenous defense manufacturing ("Atmanirbhar Bharat") is boosting demand for advanced border security systems and cyber-defense equipment. Simultaneously, the corporate and banking sectors are ramping up investments in cybersecurity to combat ransomware and data breaches, which are becoming increasingly sophisticated. The expansion of Smart Cities is also a major catalyst, creating a sustained demand for integrated physical security systems like intelligent video surveillance, biometric access control, and automated barriers.

Top Emerging Trends in the India Security Market:

- Rising Adoption of Integrated Physical and Cyber Security Solutions: Organizations increasingly deploy unified security platforms combining surveillance, access control, cybersecurity, and analytics to manage risks across physical and digital environments efficiently.

- Growing Use of AI and Video Analytics in Surveillance Systems: AI-powered video analytics enable real-time threat detection, facial recognition, behavior analysis, and faster incident response across public and private infrastructure.

- Expansion of Cloud-Based and Managed Security Services: Enterprises are shifting toward cloud-hosted and managed security services to reduce upfront costs, improve scalability, and ensure continuous monitoring.

- Increasing Demand for Smart Access Control and Biometrics: Adoption of biometric authentication, smart cards, and mobile-based access systems is rising across offices, airports, and residential complexes.

- Heightened Focus on Compliance and Data Protection Standards: Organizations are strengthening security frameworks to comply with data protection regulations and industry-specific safety mandates.

India Security Market Growth Factors (Drivers)

- Rising Security Concerns Across Urban and Critical Infrastructure: Increasing urbanization and infrastructure expansion are driving demand for advanced security solutions across transportation, utilities, and public spaces.

- Government Investments in Smart Cities and Public Safety Projects: Smart city initiatives and public safety programs are boosting deployment of surveillance, command centers, and emergency response systems.

- Growth of Commercial Real Estate and Industrial Facilities: Expansion of offices, factories, and logistics hubs is increasing demand for integrated security installations.

- Rapid Digitalization and Increased Cyber Threat Exposure: Growing digital adoption is elevating cyber risks, driving investment in comprehensive security solutions.

- Increasing Awareness and Spending on Safety and Risk Management: Enterprises and institutions are allocating higher budgets toward proactive security and risk mitigation strategies.

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/india-security-market

Market Segmentation

Analysis by System:

- Access Control Systems (Biometrics, Keycards)

- Video Surveillance Systems (Dominant segment due to wide application in public safety)

- Alarms and Notification Systems

- Intrusion Detection Systems

- Barrier Systems

- Others (Drone monitoring, etc.)

Analysis by Service:

- System Integration and Consulting (Crucial for unifying physical and cyber security)

- Risk Assessment and Analysis

- Managed Services

- Maintenance and Support

Analysis by End User:

- Government (Largest spender due to defense and infrastructure protection)

- Military and Defense (High demand for advanced warfare and surveillance tech)

- Transportation (Airports, Metro rails)

- Commercial (IT parks, BFSI)

- Industrial

- Others

Regional Insights:

- South India: Leading region due to the presence of major IT hubs and defense R&D centers.

- North India

- West & Central India

- East India

India Security Market Recent Developments & News

- Defense Exports: India's defense exports hit a record ₹210 billion in FY25, highlighting the growing capability of domestic manufacturers.

- AI Centers: Establishment of the Indian Army's AI Incubation Centre and Air Force's Centre of Excellence for AI to drive technological advancements in security.

Why Buy This Report? (High-Value Insights)

- Granular Segmentation: Detailed analysis of Physical vs. Cyber Security convergence, helping integrators offer holistic solutions.

- Regional Hotspots: In-depth breakdown of demand in Border States vs. Metro Cities, identifying specific security needs.

- Future-Ready Trends: Insights into the adoption of Autonomous Security Robots, highlighting the future of unmanned protection.

Key Highlights of the Report

- Market Forecast (2026-2034): Quantitative data on market value and steady growth.

- Competitive Landscape: Comprehensive analysis of key market players and their indigenization strategies.

- Strategic Analysis: Porter’s Five Forces analysis and value chain assessment.

- Technological Trends: Insights into advancements in encrypted communication and threat intelligence.

Get Your Customized Market Report Instantly: https://www.imarcgroup.com/request?type=report&id=8912&flag=E

Customization Note: If you require specific data we can provide it as part of our customization services.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302